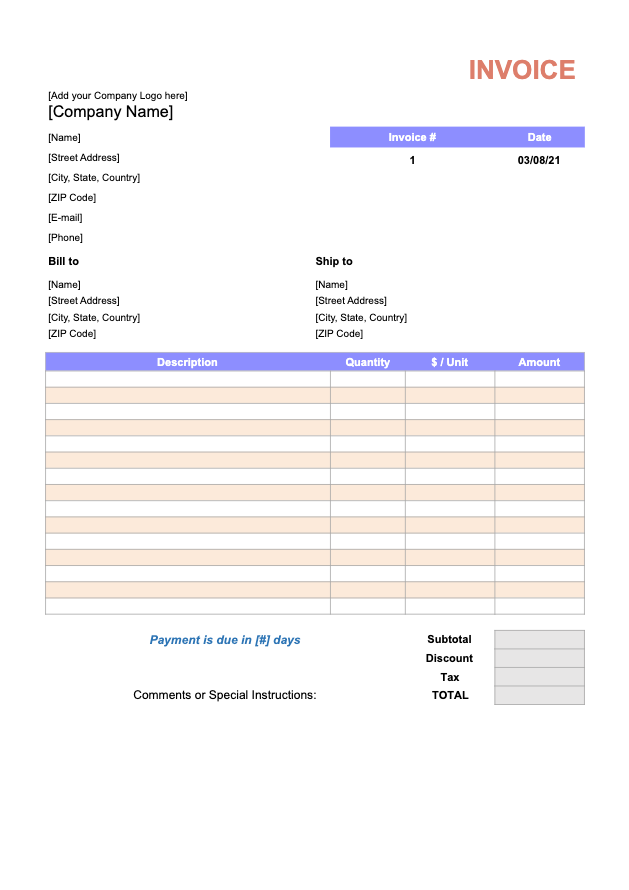

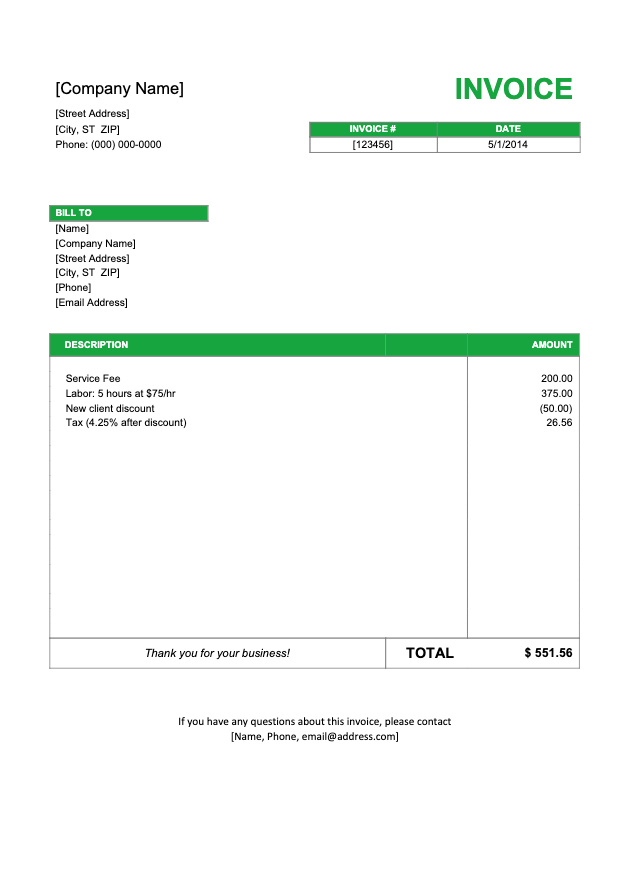

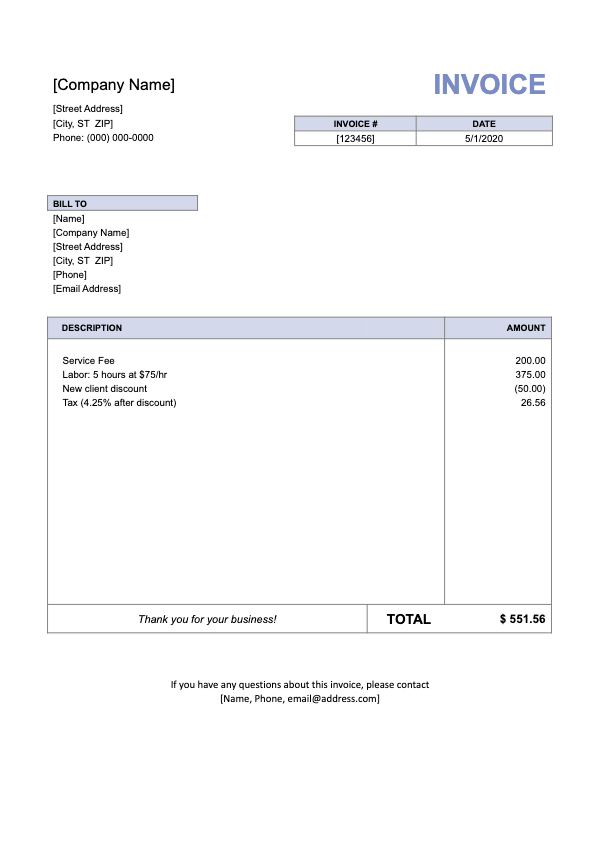

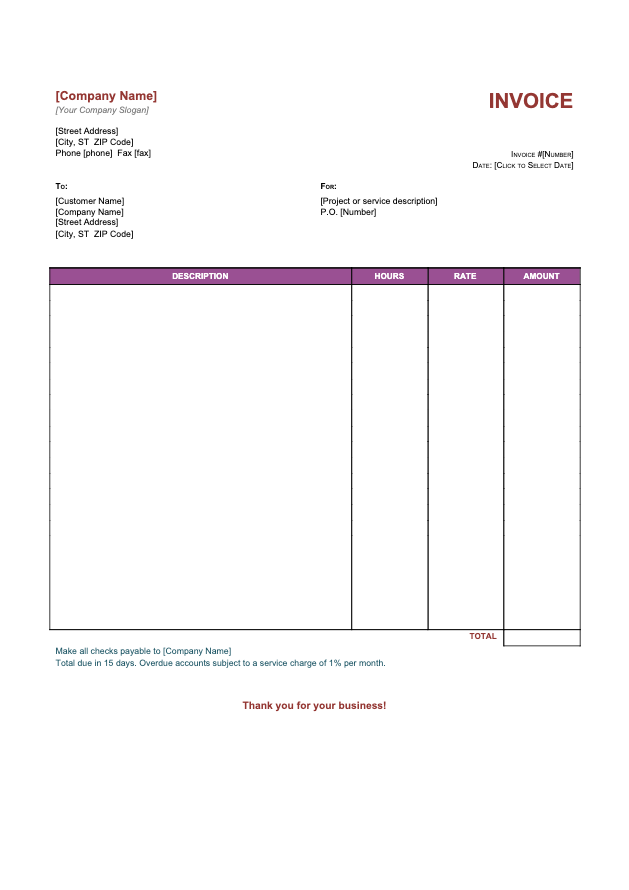

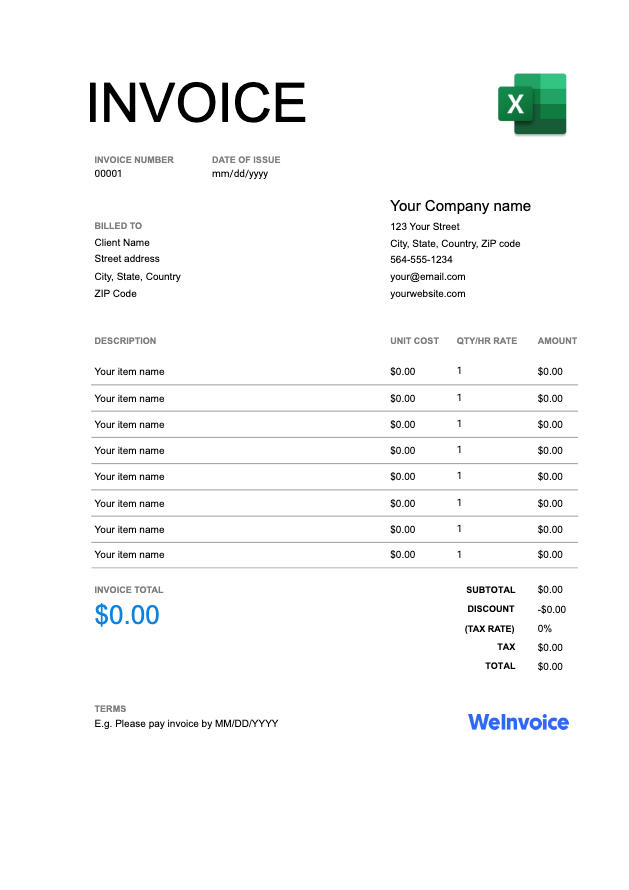

Download GST Aus Invoice Templates for Free

An Australian gst invoice is mostly used when the products are sold to another with the objective of reselling them, as different from selling to the end user or customer. Customize one at WeInvoice for your own needs.

To issue tax invoices is customary for every business registered for GST in Australia. This is because any GST-registered customer who wants to claim a credit can only do so if they have a formal tax invoice. An Australian gst invoice can help you manage and keep track of the cash flow in your business.

An Australian gst invoice is mostly used when the products are sold to another with the objective of reselling them, as different from selling to the end user or customer. Customize one at WeInvoice for your own needs.

For many people, invoices are just another set of time-consuming paperwork but they are not. This article says a lot more about Australian GST invoice, what a gst aus invoice is used for and the legal requirements of an Australian gst.

What Is Australian GST Invoice?

An Australian gst invoice is a tax invoice issued by businesses that have registered for Goods and Services Tax (GST) to their clients.

Generally, when a business makes a taxable sale of more than $82.50, inclusive of GST, their GST-registered client still needs an Australian GST invoice to claim credit for this tax in the purchase price.

What Is Australian GST Used For?

An Australian gst invoice is issued for the following reasons:

- Assists the buyer in claiming GST credit

- Can be used as a payment reminder

- Gives the business a more professional outlook

- Assists the business in complying with the country’s laid down tax laws so they can enjoy the benefits that accrue to those who do.

Australian Legal Requirements for GST Invoice

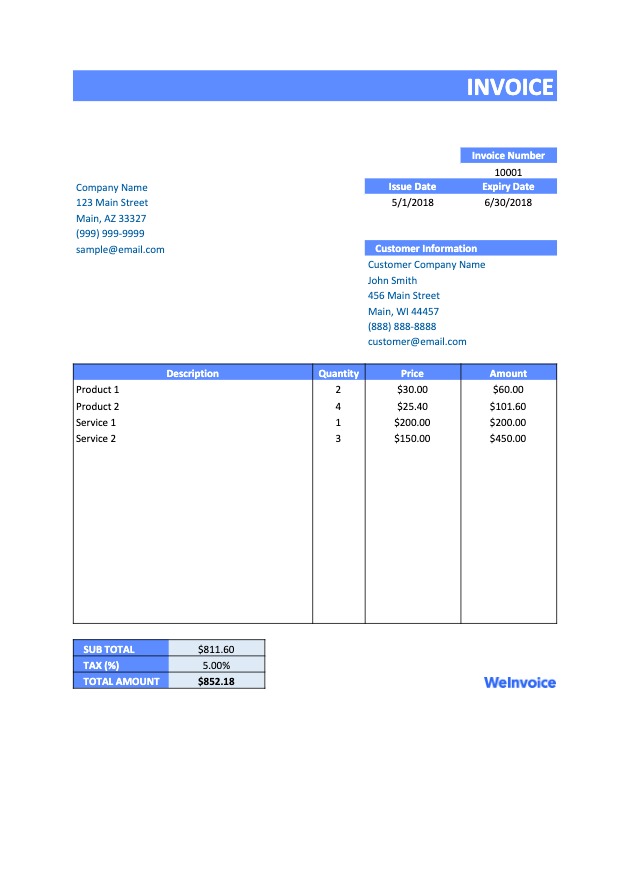

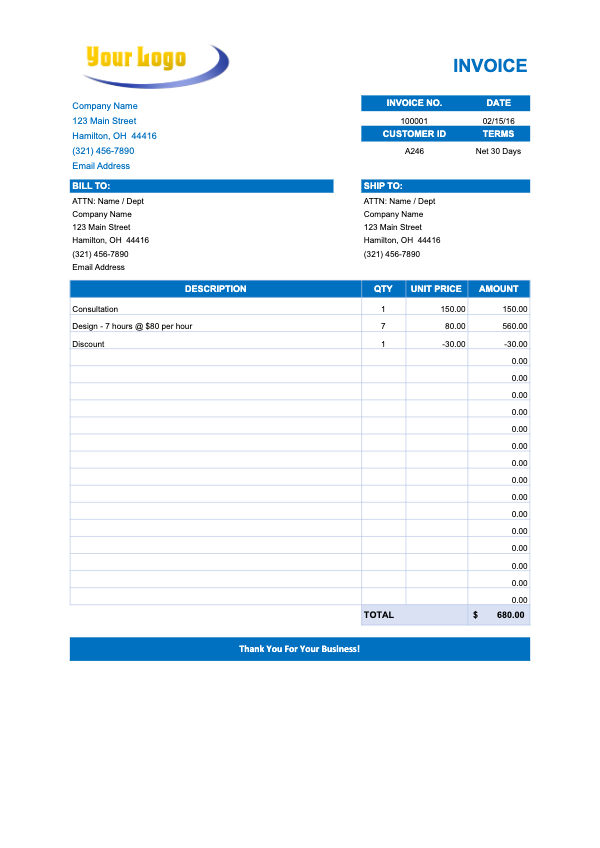

For an Australian gst invoice to be valid (for sales less than $1000), it must contain the following details:

- The header ‘Tax invoice’

- Seller’s identity

- Business name and contact details.

- Australian Business Number (ABN)

- Invoice issue date which is the date the invoice was issued

- Itemized list of goods and services provided including their prices and quantities

- The GST invoice must reflect the extent to which item delivered includes GST. In general, this requirement is met if the invoice;

Clearly shows the GST mount for each time; Or states in clear terms that the total price includes GST

To help the client understand better, this GST amount is usually written out for each item alone. The only exception is when the GST amount payable is exactly one-eleventh of the total price. In this case, the statement “Total price includes GST" suffices.

For GST invoices drafted for sales of $1000 or more, the tax invoice should as well contain:

- The buyer’s identity. An ABN can also be used in place of the buyer identity as well.

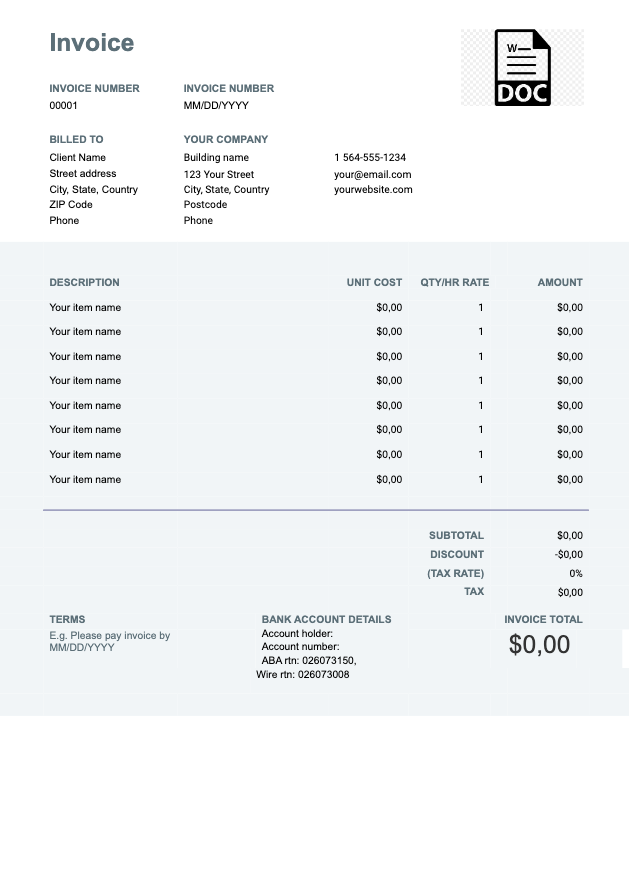

Create an Invoice With WeInvoice

Design your own business invoice and add as many customizations as you need in your invoice. Improve the efficiency of your business by using a quick and easy invoice generator service from WeInvoice.

Once an invoice contains details about GST, it is considered a tax invoice. As a rule, only GST-registered businesses are required to draft a gst aus while those who are not GST-registered can issue a regular invoice. So before drafting an invoice, it is pertinent you conduct due research to know whether you should issue a standard invoice or GST invoice.

Whichever invoice you choose to draft, WeInvoice has a lot of templates that can help you with. Its amazing invoice generator may also be useful for developing a custom and stylish gst invoice.

Other Invoice Templates