Download Invoice Templates for Free

Why should invoicing your clients be expensive for your business? Now you can create invoices for free without having any accounting background. We provide free invoice templates for businesses to use to get paid for their work, products and services.

Why Would You Need an UK Invoice?

Basically, an UK invoice is an instrument for billing clients. However basic it may seem, it also serves a lot of other functions. Some of them are:

- Inventory management tool: For business owners who deal with physical products, an invoice can help know which products are readily available and which ones need restocking.

- Suffice as legal protection: Since an UK invoice shows the services provided and the work timeline, it can be used as proof of work done and time frame should any issue arise.

- Resource for verifying tax claims

- It can be used as a tool for projecting future revenue

How to Make an UK Invoice?

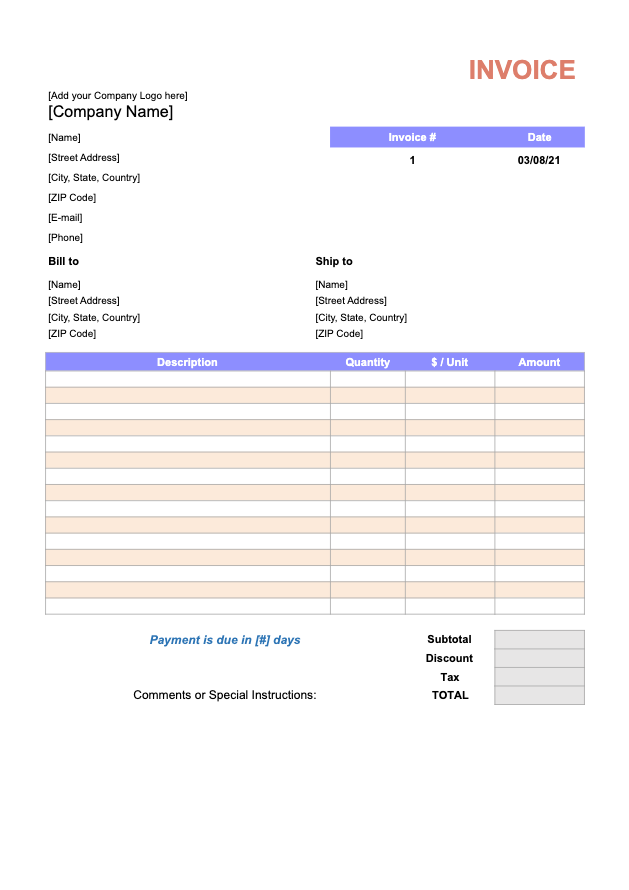

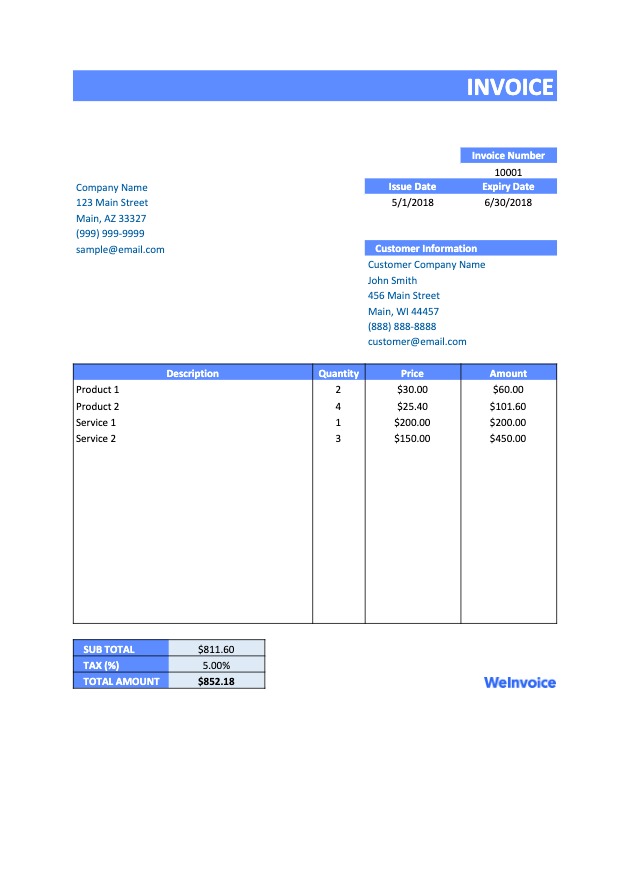

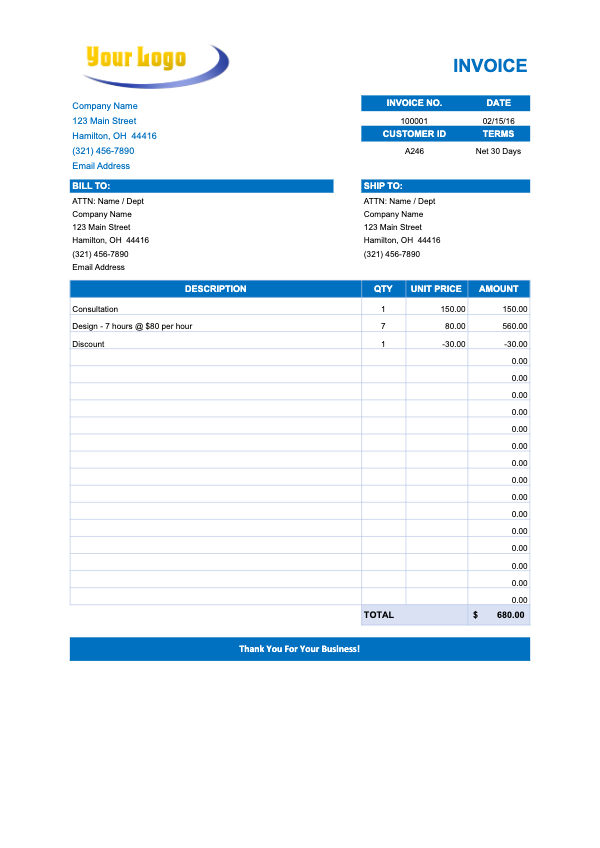

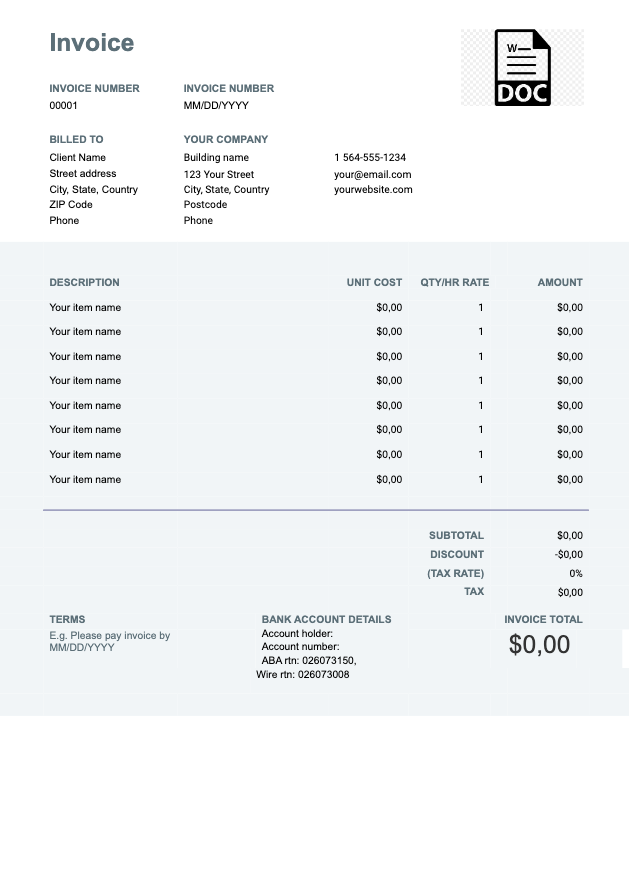

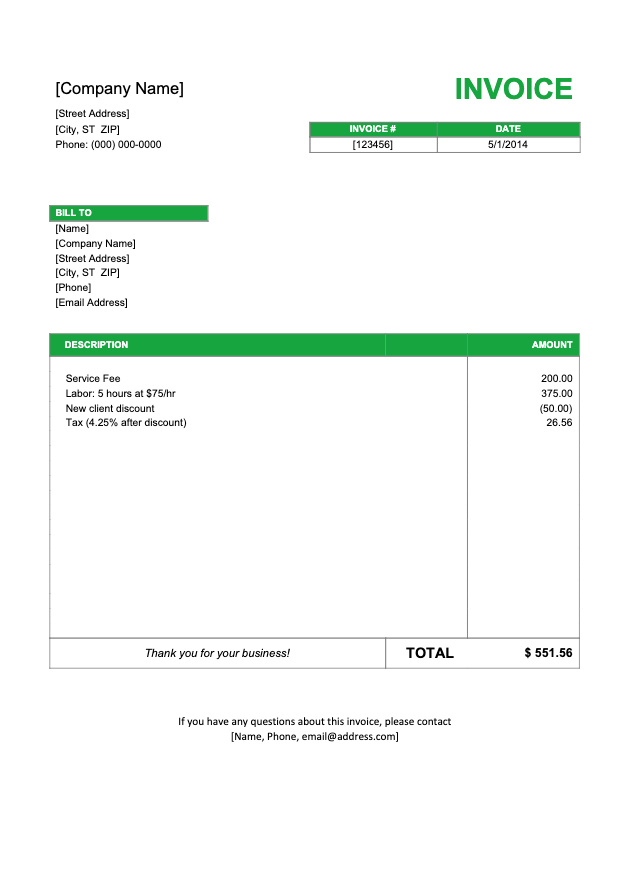

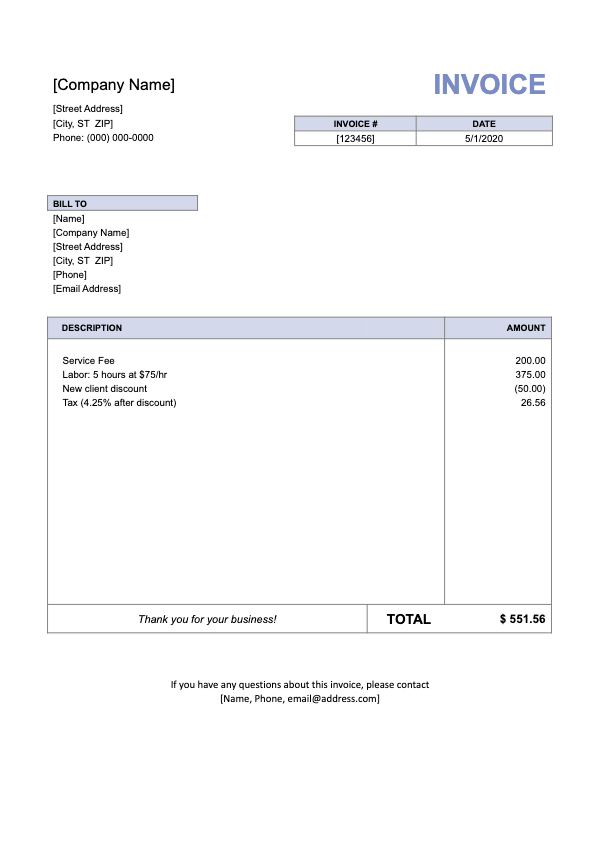

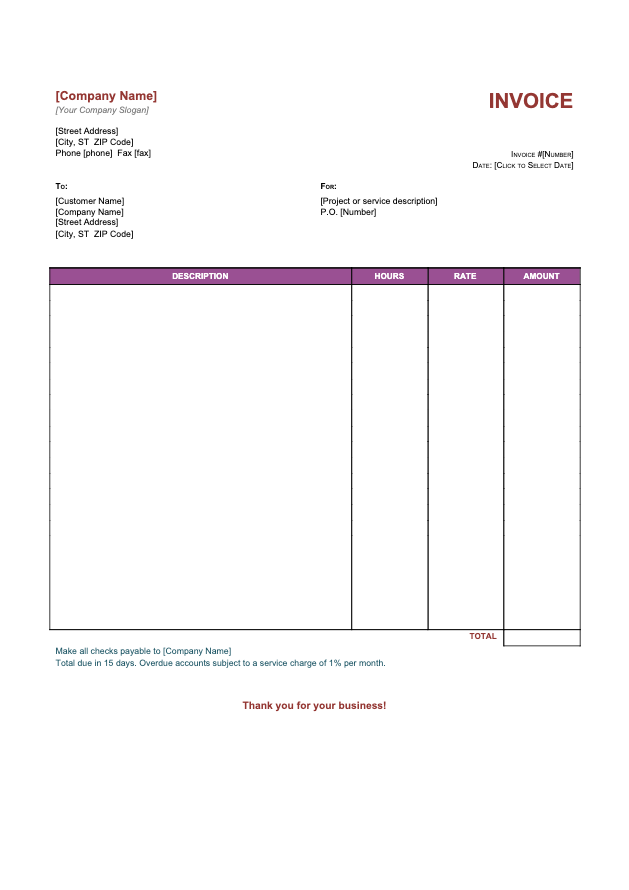

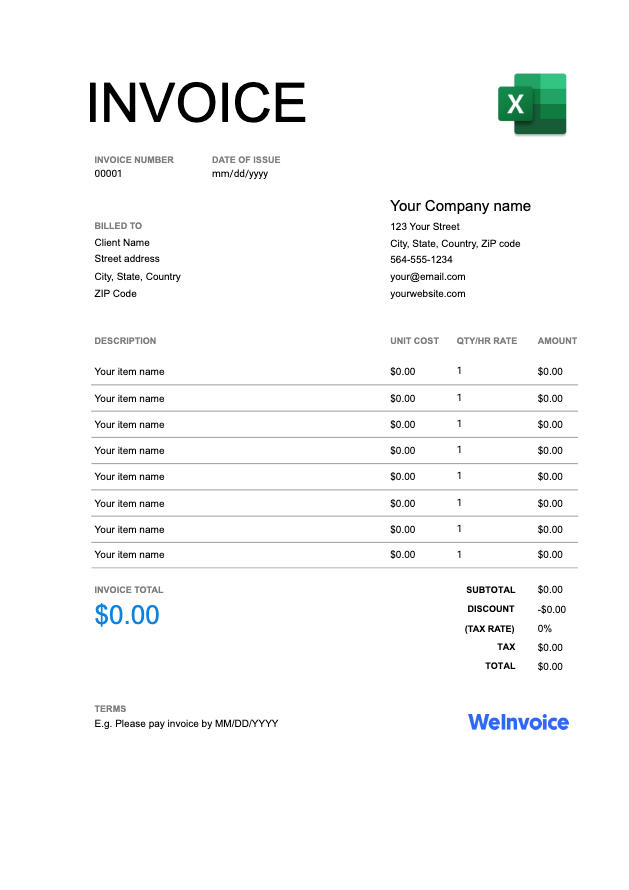

Making an UK invoice should come easy once you pay attention to detail and draft it in accordance with the invoicing requirements in the UK. A good place to start is downloading a free UK invoice template from a well-organized template hub like WeInvoice.

Outlined below are the other steps to take:

- Open the UK invoice template

- Enter your business information. Insert your business branding portfolio (logo and mission), business name, business contact address, phone number and email address

- Insert your client name, billable contact address, phone number and email address.

- Write out the invoice date. The invoice date is the date the invoice was issued

- Assign a unique invoice number to the invoice. This invoice number can be assigned to each UK invoice sheet using the sequential numbering system.

- Give a brief description of each product supplied and services provided

- Itemize the goods and services provided

- Write out the cost of a unit product or hourly rate

- Quantity of goods provided or number of billable hours

- Payment terms

- Amount due and payment due date

UK Invoicing Requirements

Invoicing has general rules but there are some of these rules that are peculiar to the invoicing system in the UK. Here are some of these rules or requirements:

- An header with the word “INVOICE" is non-negotiable

- Compulsorily, the invoice must contain all the details of a limited company

- Timesheets must be attached to the invoice if applicable

- The invoice must be assigned a unique invoice number generated using the sequential invoice numbering system

- VAT number

- Payment details must be clearly highlighted. In the UK, the format is the bank account number followed by the sort code

- Net taxable value of the sale must be recorded in Pound Sterling

- Payment terms and due date must be clearly written out on the invoice.

Also, the invoice must contain:

- Full contact address of the seller

- The quantity of goods supplied

- Unit price of the products or goods supplied excluding VAT

- Cash discounts (if applicable) and excluding VAT

- Cost of delivery or transporting the goods.

Make an Invoice with WeInvoice

Design your own business invoice and add as many customizations as you need in your invoice. Improve the efficiency of your business by using a quick and easy invoice generator service from WeInvoice.

FAQs

What invoice format should I use?

This depends on what industry you are in. An invoice format may be right for a freelancer but not proper for a trader. The right one for you is the one with editable fields that relate to the kinds of goods or services you provide. The popular formats are Word/Google Docs, Excel/Google Sheets and PDF invoice template.

How is VAT on invoices calculated?

In the UK, the norm is a VAT rate of 20%. However, there are some product categories with a reduced VAT rate. Some supplies are charged at only 5% reduced VAT rate while children supplies and necessities like food have no (0%) VAT rates. Otherwise, most products listed on the invoice will be taxed at the standard 20% VAT rate.

How do I charge VAT in the UK on my invoices?

Since VAT is collected at every point in the value chain, you are expected to charge the client the VAT on all taxable sales. Zero-rate items like food and children supplies are not exempted.

Although this cost is usually pushed to the customer (final point of sale), you will be paying this to the HMRC when filing your VAT return. So, you have to charge your customer this VAT to get the real financial worth of the sale.

What payment method can I itemize as my acceptable payment method?

There are different payment methods including payment by cash, bank transfer, credit/debit card, payment platforms like PayPal or cryptocurrencies. Payment through cryptocurrency is the least acceptable. Most businesses in the UK prefer to receive bulk payment through bank transfer, cheque or card payment.

If you choose to use this payment method, remember to include your bank name, sort code and account number in your invoice while drafting it. You may also choose to receive pay via cheque. In this case, you should include a postal code in the invoice. If you choose the card payment option, keep in mind that it attracts some processing fees.

It has been established that invoice templates can simplify the invoicing system. But that’s if they are well formatted, and detailed. WeInvoice is your best shot at getting such invoice templates. At WeInvoice, you will find customizable UK invoice templates to download for free.

Other Invoice Templates