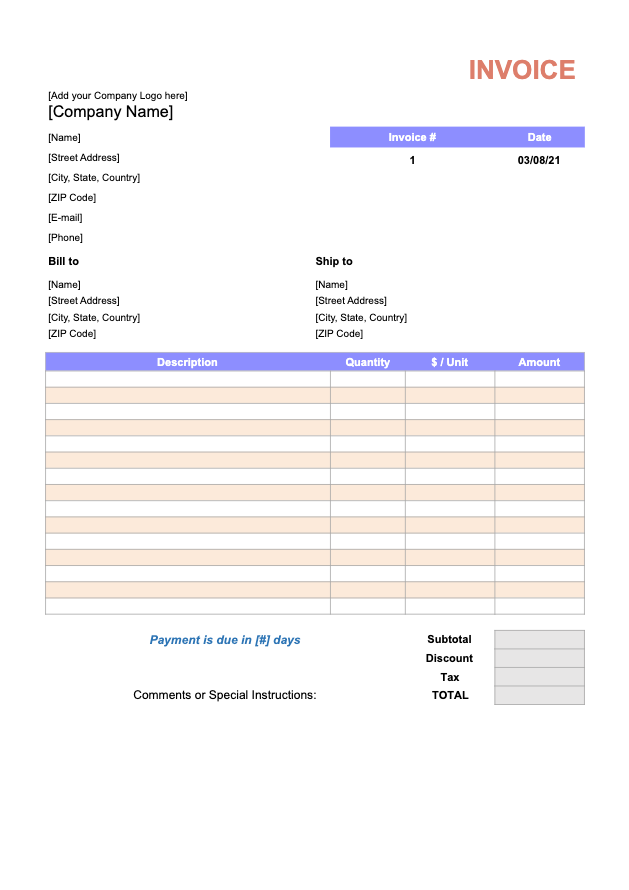

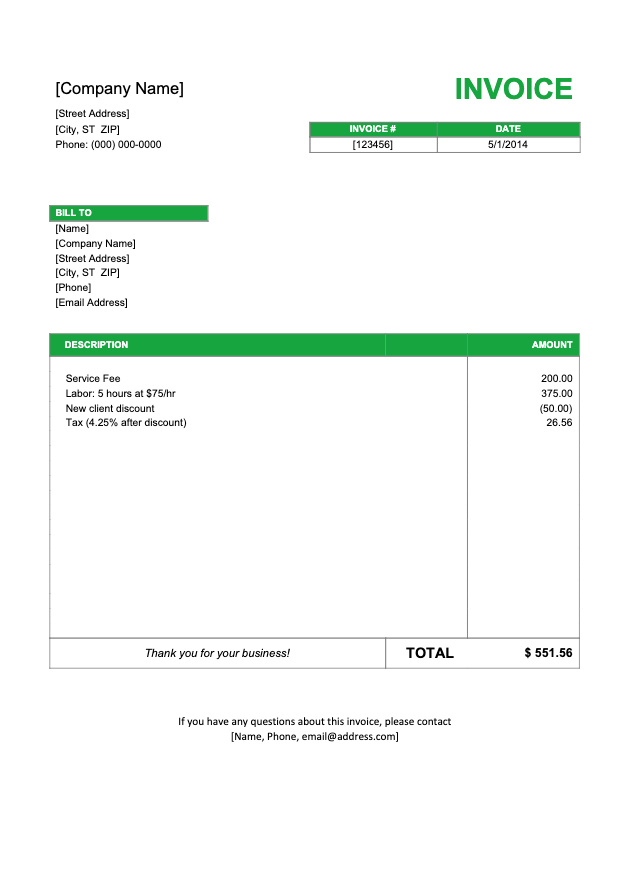

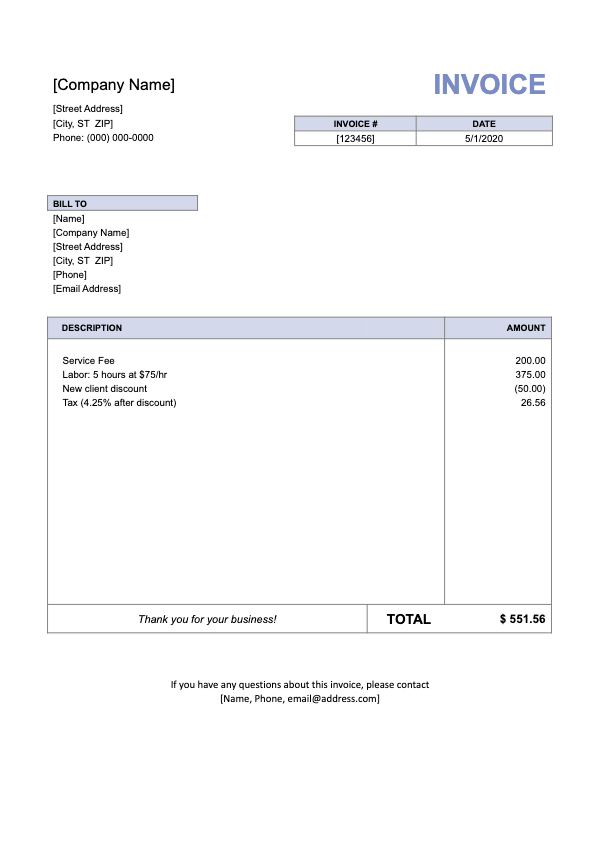

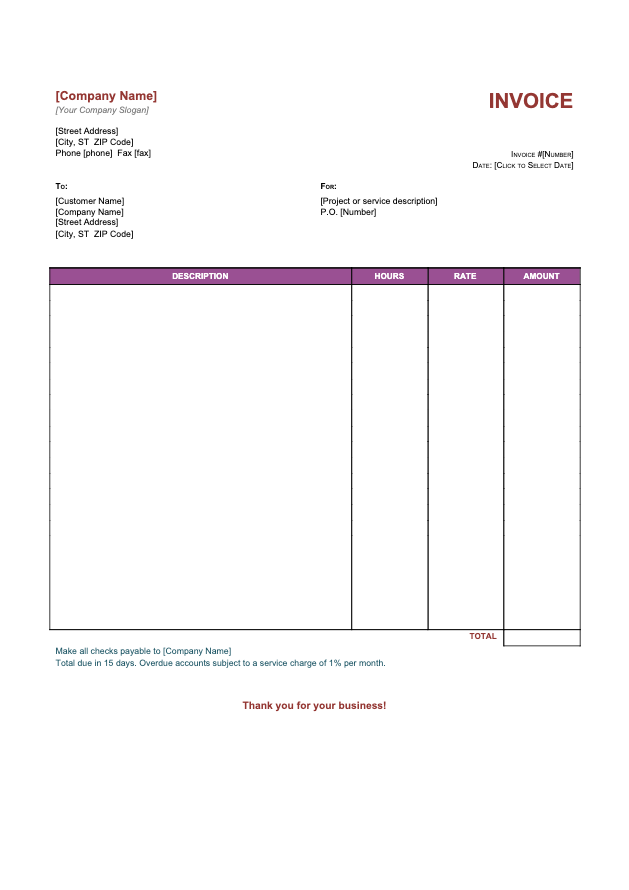

Download Business Invoice Template for Free

Your invoice template should be just as professional as your business. Download the perfect business invoice template for free with a single click from WeInvoice. Add more transparency in the billing process with your client.

What Is a Business Invoice?

Every business revolves around serving its clients. As such, they need to provide clear and self-explanatory invoices to the clients for the services or products provided to them.

A business invoice lists the items for which you are billing your client and how much they need to pay you. Through a business invoice, you provide your client with a clear understanding of what’s due and a record of the services or products they obtained from you.

It is an effective tool for the collection of your pending dues since other alternatives such as orally stating the payment due can lead to you chasing your client for unpaid dues.

A business invoice tends to be concrete proof that you have demanded payment from your client. The invoices are important not just for payment tracking but also for filing taxes at a later time.

Types of Business Invoices

There are various types of professional invoices that businesses use for billing their clients. Some of these business invoices include:

Pro Forma Invoice: Standard invoices are the most common and simple form. It has a versatile format that any sector can use, and these are generally used by all small businesses. It includes the business name, client name, invoice number, and the money owed.

Standard Invoice: Catering business involves a lot of dues in terms of services performed, and many for the products that have been purchased. The invoice you provide your client should detail what amount is due for what purpose

Interim Invoice: Interim invoices are used in long-term projects. When the final deliverables can take some time, an interim invoice is sent during an ongoing project to request payment for the services performed so far.

Recurring Invoice: Recurring invoices are also used for long-term projects which require payment now and then. A major difference between recurring invoices and interim invoices is that while interim invoices have final deliverables, recurring invoice projects can go on as long as the client wishes.

Credit Invoice: Credit invoices involve the payment from the business to the client. This is generally done for discounts, refunds, or to correct an error in the billing process. It is important to use the negative sign (-) while surmising the amount in a credit invoice.

Debit Invoice: Debit invoices are invoices that require additional payment from the client to the business for any extra work that was not included in the main invoice.

Final Invoice: The final invoice is the last and main invoice that a business sends to the client for requesting the due amount. It is a good idea to summarize the past payments by the business to the client in the final invoice.

Past Due Invoice: Past due invoice is sent if the client does not make the payment within the due date. This is used to remind the client that the payment is due, and it may include any applicable late fee.

Make an Invoice With WeInvoice

Design your own business invoice and add as many customizations as you need in your invoice. Improve the efficiency of your business by using a quick and easy invoice generator service from WeInvoice.

What Information Should Be Included in a Business Invoice?

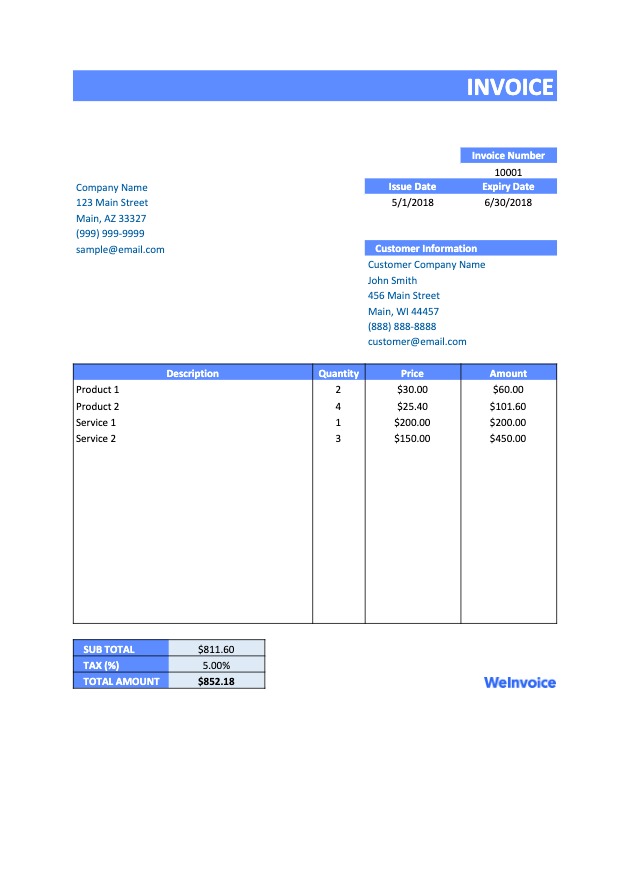

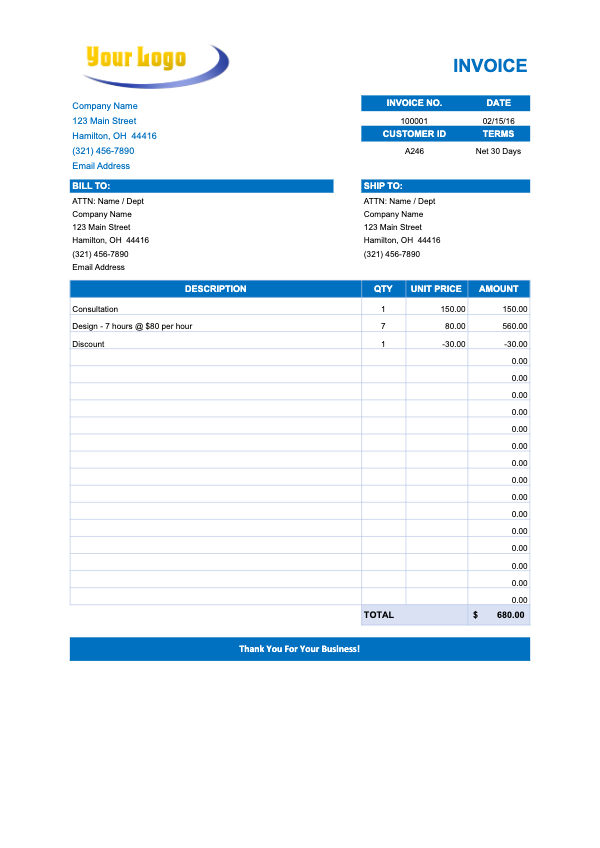

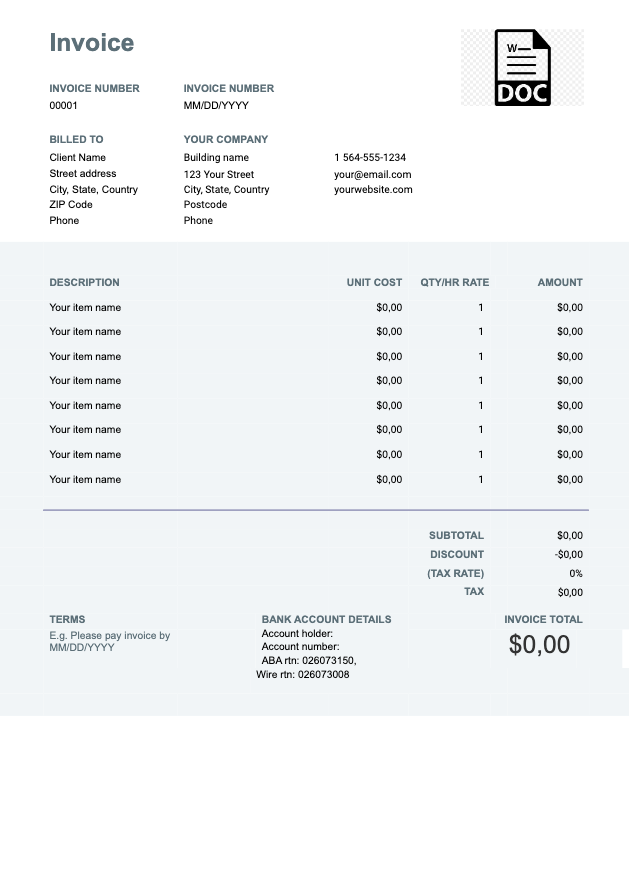

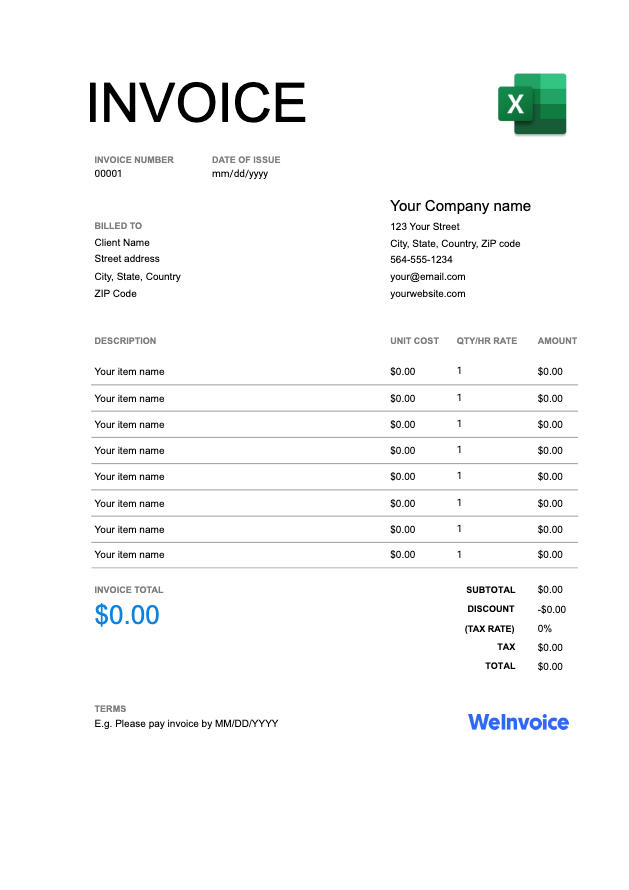

Business invoices have many elements that add to the purpose of creating the invoice. Some of these elements include:

Business Name and Address: A business invoice should have the registered name and the registered address of your business on the top. It is also recommended to add your business contact phone number and email address.

Client Information: The invoice should include the name of the person you are billing and their contact address. If you are billing a company, you can have the company name and address.

Description of Service: The business invoice should list the services or the products provided to the client, along with the quantity and cost of each.

Date of Issue: There should be a breakdown of the products and services that you provided to the client. It is better to list these costs separately so that the client understands which payment is for which thing. The amount due for each product/service should be listed next to it.

Total Amount Due: The total amount due should be listed, along with any applicable taxes. If there are taxes, a grand total amount that is due should be mentioned too.

Date of Issue: Every invoice should have the date on which the invoice is issued. This provides an estimate to the client that they should pay within the due date.

Invoice Number: nvoice numbers are useful for record-keeping and invoice tracking purposes. Through an invoice number, it is easier to file taxes. You can also find out which invoices have been paid and which are still pending.

Conclusion

If you want to create a business invoice template that you can easily edit and use for your business, WeInvoice is the perfect place to do it. Create your invoice any way you want, and download it completely free.

Try WeInvoice today!

Other Invoice Templates