Download Self-Employed Invoice Template for Free

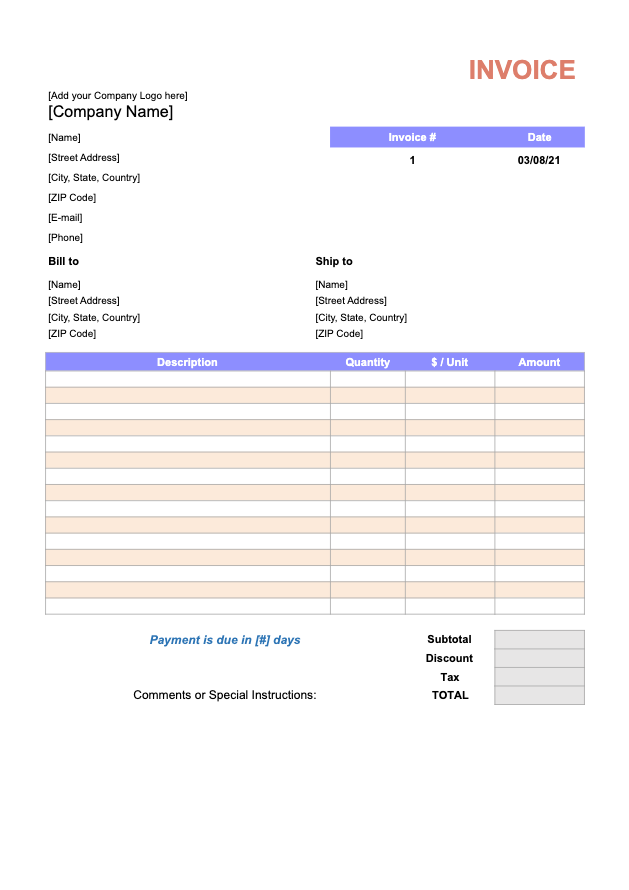

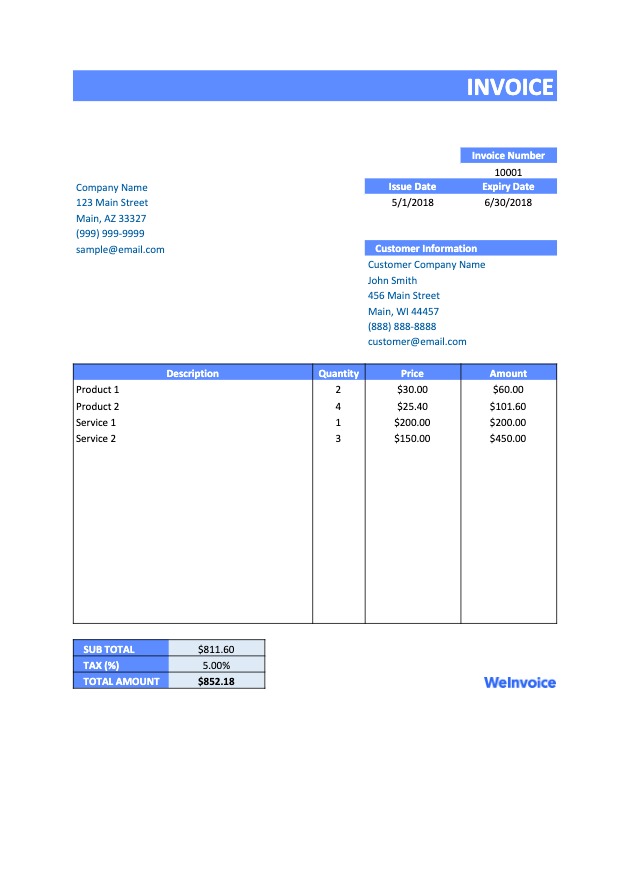

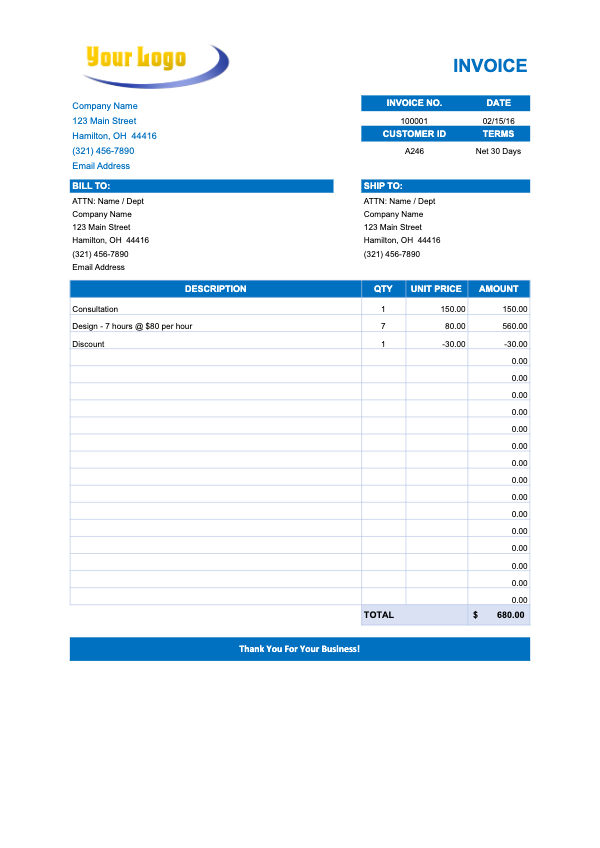

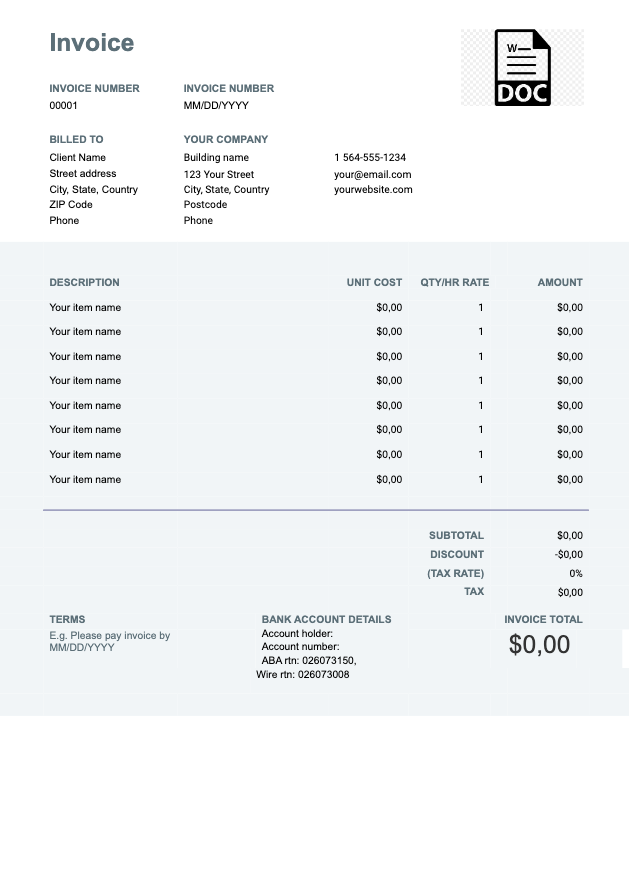

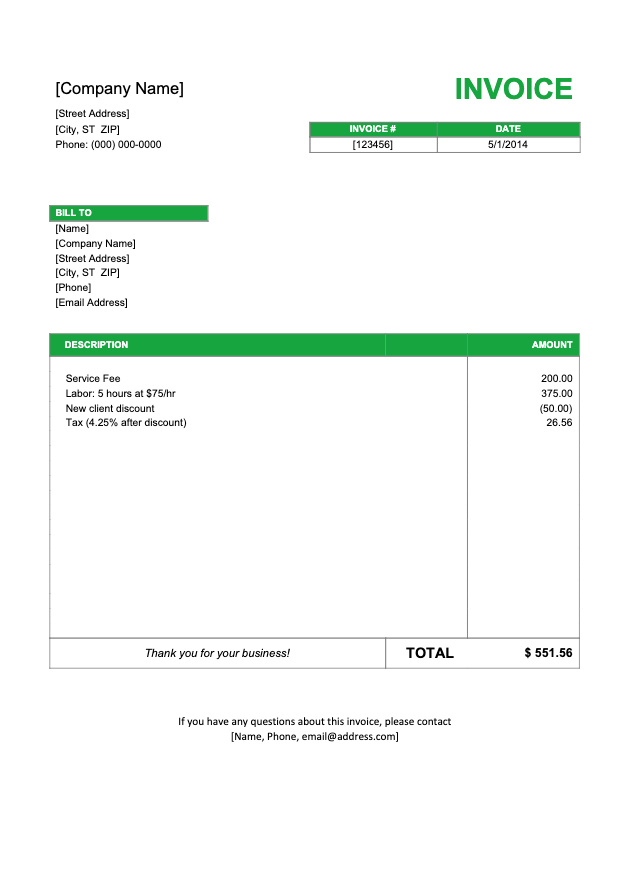

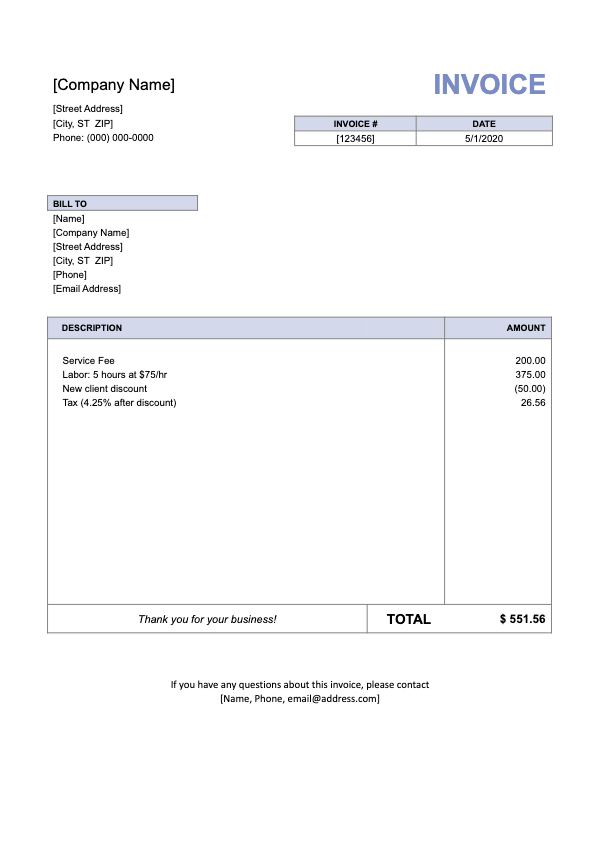

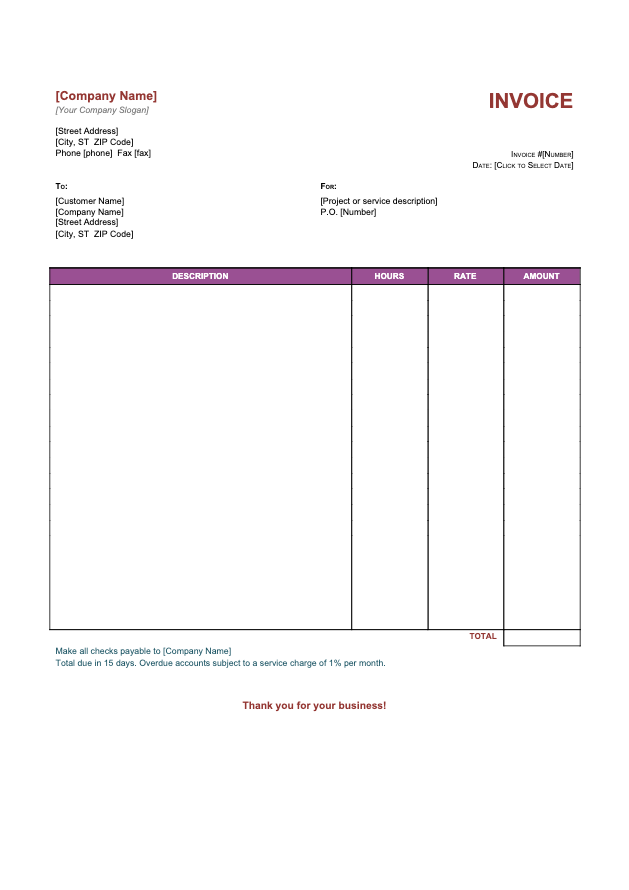

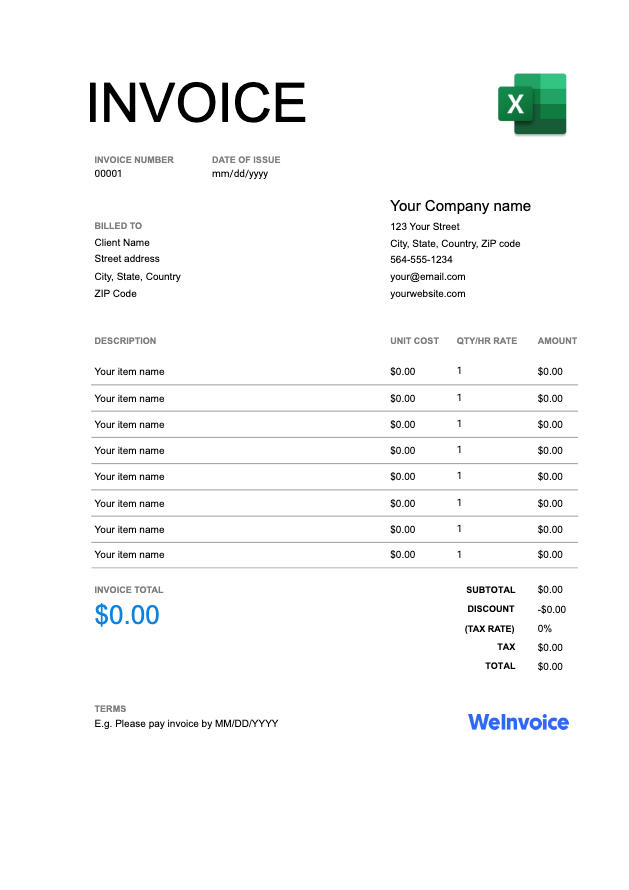

WeInvoice provides completely customizable self-employed invoice templates that you can download for your own business. Add your company logo or your business header with a single click. Download, print, or save the file online without paying for anything.

What Is a Self-Employed Invoice?

As a self-employed person, you probably manage and run your own business. Therefore, you have to handle the finances as well, including billing your clients.

However, improper billing methods can be a nuisance to handle. If the invoice is unfair to your client, it can lead to a drift with your client and make you lose business. If the invoice is unfair to you, it can lead to financial losses that you won’t find out about till it is too late (or never).

You need a proper billing method through which your client can know how much you are billing them and for what service/project. A self-employed invoice is a perfect solution to the issue as it provides details on what the client owes you.

What Is a Self-Employed Invoice Used for?

A self-employed invoice is useful for your client as well as yourself. Some of the uses of this invoice include:

Make an Invoice With WeInvoice

Design your own business invoice and add as many customizations as you need in your invoice. Improve the efficiency of your business by using a quick and easy invoice generator service from WeInvoice.

What Is Included in a Self-Employed Invoice?

The components of a self-employed invoice can be modified as per your requirement. In general, the following parts are common in a self-employed invoice.

Your Business Information: The self-employed invoice should have your company letterhead or name on the top. If you are a self-employed professional and don’t have a registered company name, you can use your own name as well.

Client Information: It is recommended to state the information (name and address) of the business you are invoicing. If there is a particular client you work for, you can use the client’s name.

Description of Service: The invoice should mention the services for which you are billing your client. If there are multiple services you provided or multiple instances of the same service, you can mention each of them individually.

Date of Issue: All invoices contain the date on which the invoice is issued. They can also mention the due date or time period of paying the invoice.

Payment Due: If there are multiple services provided, payment for each service should be mentioned in the invoice. It should also have the total payment that is due, along with any taxes if applicable.

Invoice Number: Invoice number turns out to be quite helpful when your client or you are organizing your invoices at a later time. You can find out which payment was received regarding which invoice, all thanks to the invoice number.

Conclusion

Self-employed invoices are easy to create and customize if you make them at WeInvoice. WeInvoice already services countless self-employed professionals throughout the world. Check on invoice templates from WeInvoice and create a self-employed invoice template for free!

Other Invoice Templates