Download Tax Invoice Templates for Free

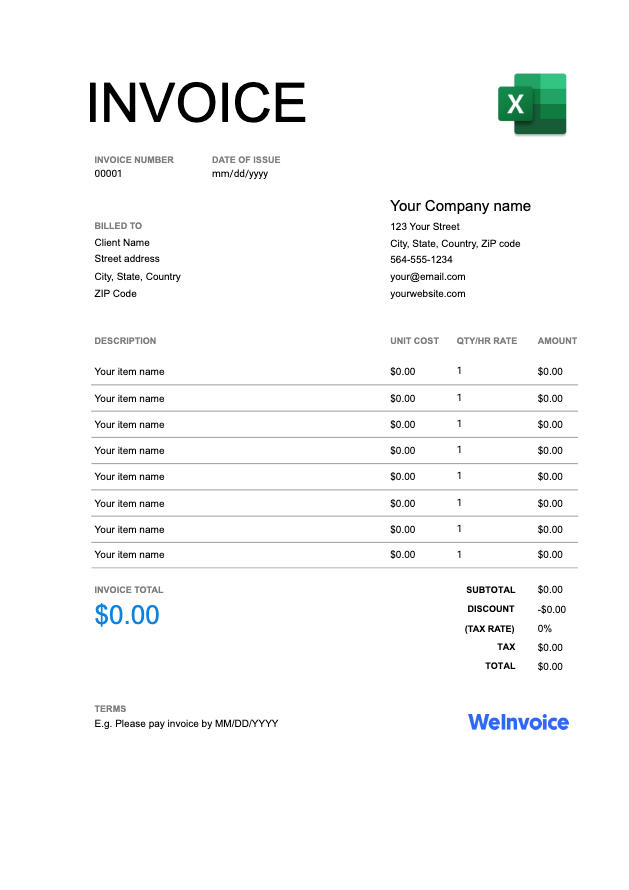

What better way to draft a tax invoice than using a tax invoice template? Personalize your own tax invoice template at WeInvoice now.

What Is a Tax Invoice?

A tax invoice as different from a standard invoice is a document sent by a vendor to the buyer containing detailed information about the quantity of goods bought, the value of such goods and services, and most importantly, the tax charged.

The taxes charged by most businesses include VAT, GST and HST. A tax invoice is usually issued by the dealer when the goods are sold with an objective of reselling them. This is because the tax-registered customers may need proof to claim their tax credits for purchases.

How Do I Make a Tax Invoice?

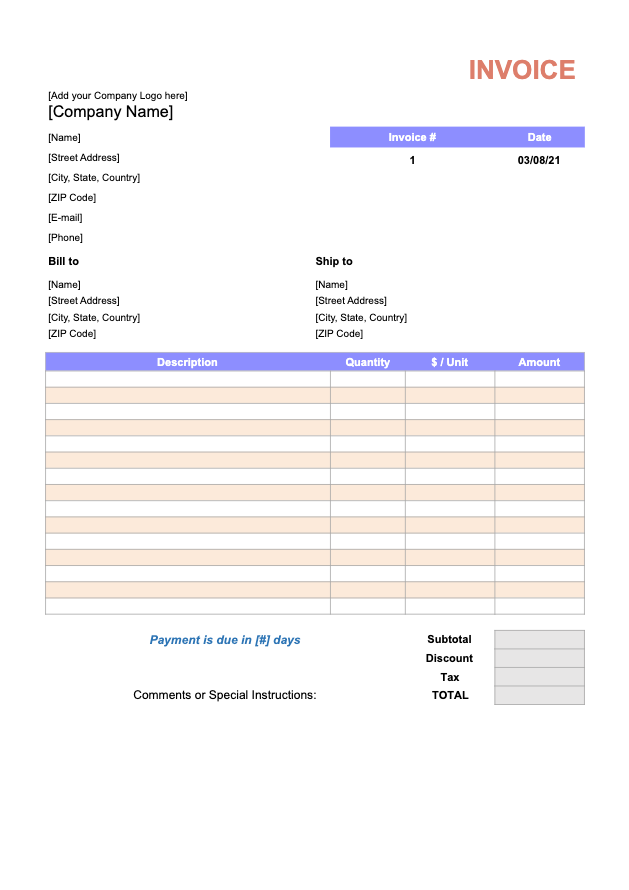

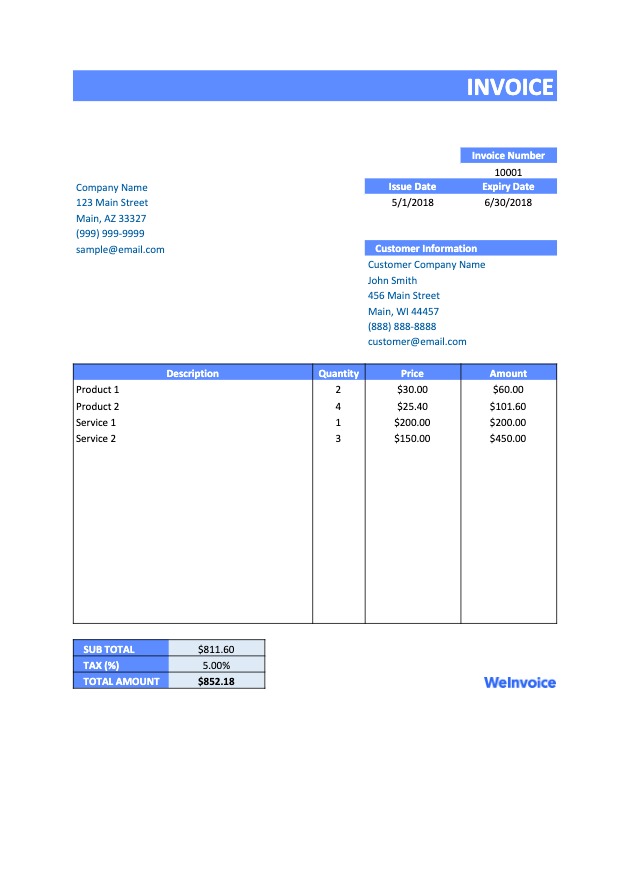

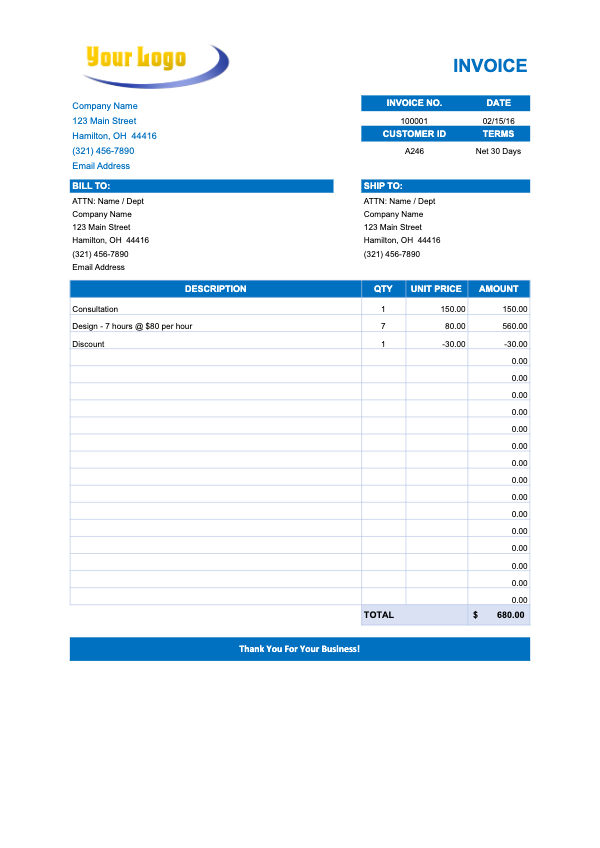

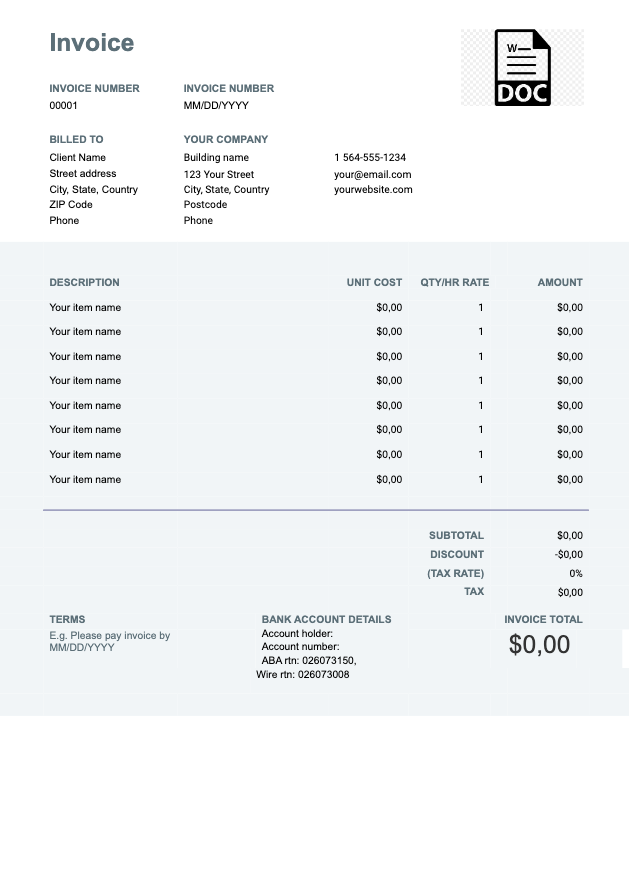

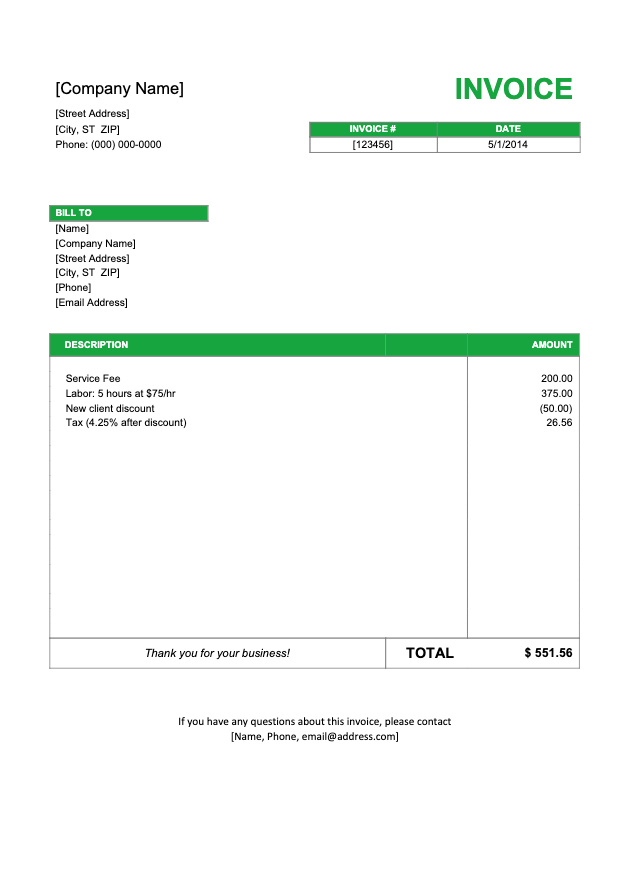

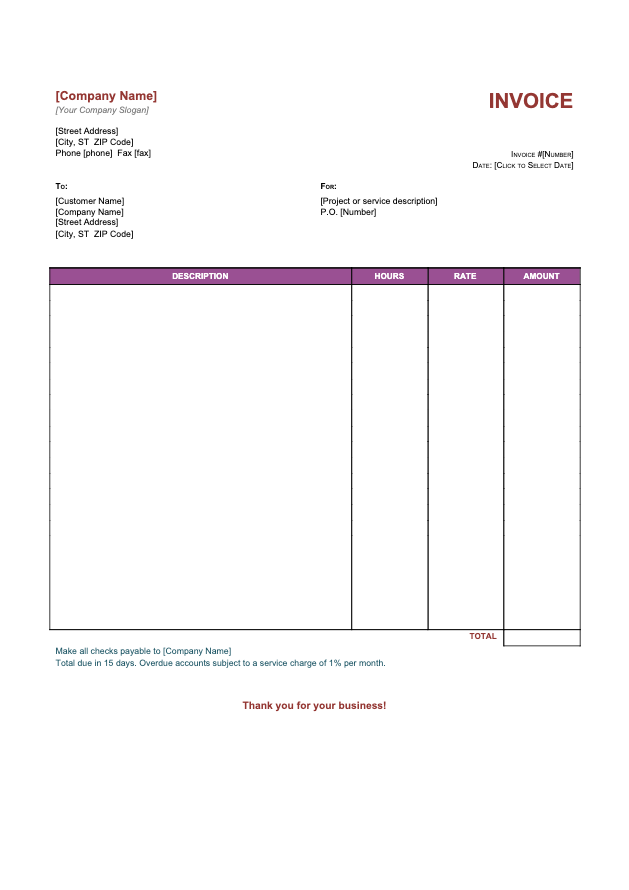

A tax invoice template can save you the stress of drawing out tables and splitting them into sections. It will also help your invoice assume the right formatting and layout, giving it a more professional outlook. Outlined below is a step-by-step guide on creating a tax invoice.

- Begin with downloading a free tax invoice template from an invoice template hub like WeInvoice. Its invoice templates are stylish, customizable and can be downloaded for free.

- Enter the words “Tax invoice" as the invoice header

- On the right side of the header section, include your business logo, vision, mission and any other branding portfolio you deem fit.

- Also include in this section your business name, phone number, fax number, email address and contact address. Since this information will be constant for all your invoices, you can save them in the tax invoice template.

- For subsequent clients, create a copy of the tax receipt template and save it using the name format “(Client name) Invoice | Date”.

- Underneath the header section and towards the left-hand corner of the tax invoice, enter the client name, billable contact address, postal code, fax number, phone number and email address.

- Next to the field where you have entered the client information, include the invoice issue date and unique invoice number.

- In the body of the invoice, itemize the products or services provided and a brief description of each of them.

- Also, enter the quantities and charges for each of the items.

- Calculate the total amount owed, considering applicable taxes, delivery fees and other extra charges. Write out the payable amount in bold font so that it is unmissable.

- Write out the accepted payment method, refund policy and other relevant details in the note section.

What Should a Tax Invoice Include?

For a tax invoice to be valid and binding, it must feature the following details:

- The word “Tax Invoice" clearly written in bold at the top of the invoice

- A unique invoice number

- Invoice issue date

- Customer name

- Billable and shipping contact address

- The vendors identity and business numbers

- Brief description of goods and services

- Price and quantity of good purchases

- Tax applied to each of these items

- Total value of the shipment including tax

- Vendor or supplier signature

What Are The Differences Between Tax Invoice and Invoice?

Traditionally, companies send invoices to customers to inform them about how much they owe for the goods and services provided.

A tax invoice isn’t so different. But it serves more. In addition to detailing the payable amount for the goods delivered, it helps the vendors, buyers and tax authorities come to terms with the tax due on particular sales.

If so, the major telling difference between a tax invoice and a regular invoice is that the former provides information about Goods and Services Tax (GST) while regular invoices do not.

Both tax invoices and regular invoices are used for drafting financial and annual accounts. But in addition to these, tax invoices can also be used to claim tax credits. Tax invoices are very useful to the government of many countries because they guide against tax evasion and many other types of fraud.

The other differences between these two can be grouped under preparation, receiver and objective.

Preparation: A tax invoice is prepared in triplicate while the standard invoice is prepared in duplicate. One of those copies is usually for the vendor while the other is for the buyer. The third one (in the case of tax invoice) would be handed over to the relevant government authority.

Receiver: It is usually presented to another business for products to be resold while a regular invoice is issued to the end consumer.

FAQ

Do I need to send a tax invoice?

Whether or not you need to send a tax invoice largely depends on whether you are registered for GST. If you are, then you need to issue tax invoices for taxable sales above a certain sum. This sum may differ from country to country.

You may also issue one for a customer who asks for it in particular. However, if you aren’t a registered GST seller, you would have to indicate this on the invoice by writing ‘price does not include GST’

Can a tax invoice template and a regular invoice template be used interchangeably?

Yes, they can. Once an invoice has the header “Tax invoice”, it is considered a tax invoice. This has nothing to do with how the invoice template is structured.

Make an Invoice with WeInvoice

Design your own business invoice and add as many customizations as you need in your invoice. Improve the efficiency of your business by using a quick and easy invoice generator service from WeInvoice.

Following the guidelines provided above, you should be able to draft a tax invoice from scratch. However, the easy way out is using a tax invoice template or invoice generator. WeInvoice has some of the best invoice templates available all for free and accessible to anyone. It’s amazing invoice generator is also feature-loaded and easy to use.

Other Invoice Templates