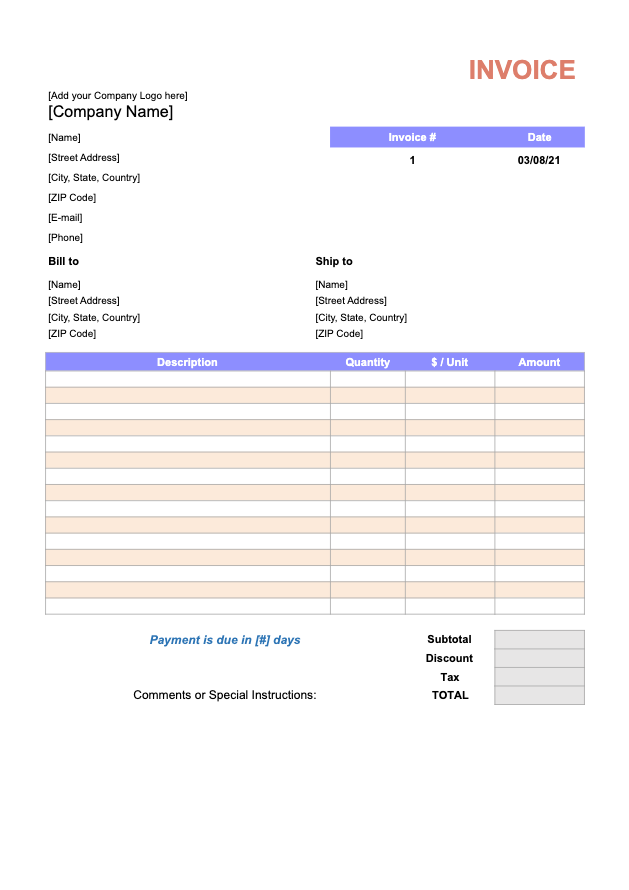

Download VAT Invoice Template for Free

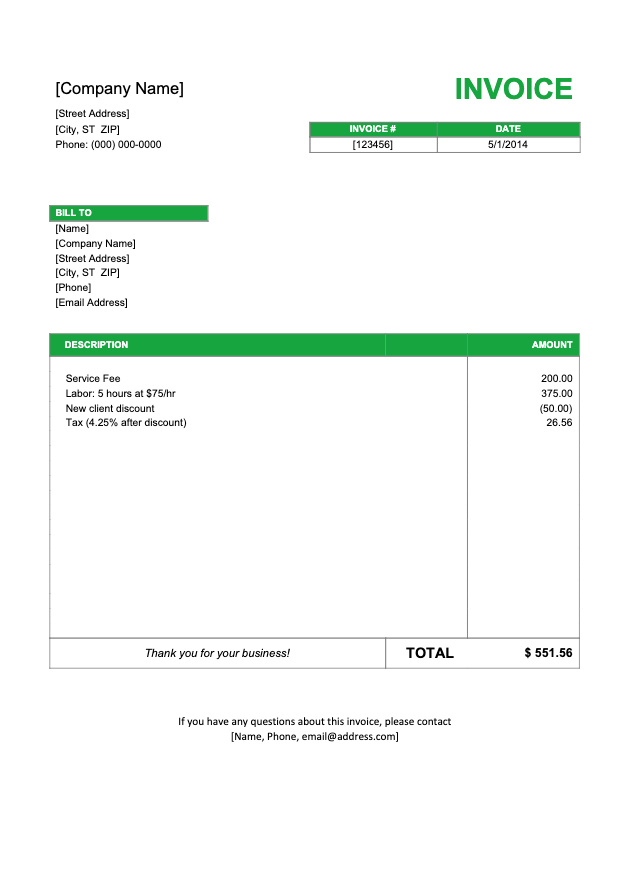

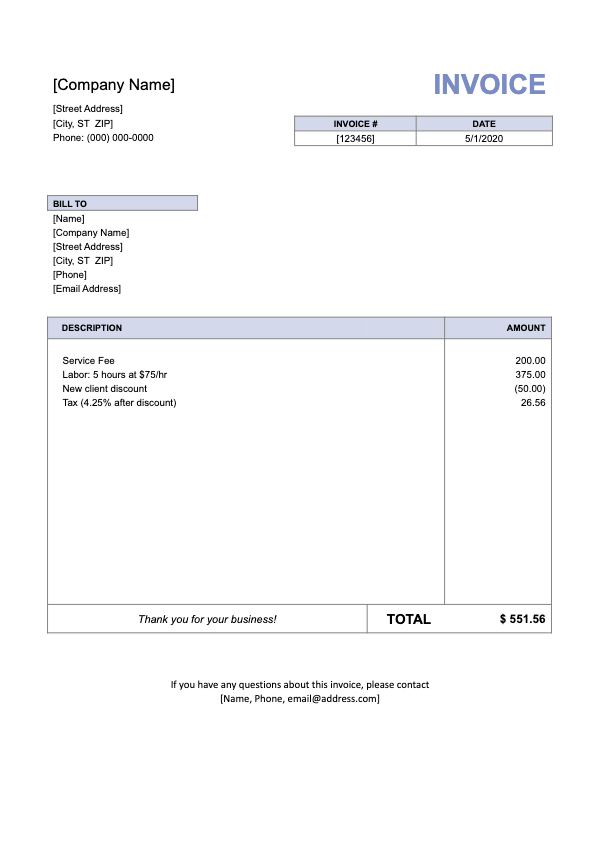

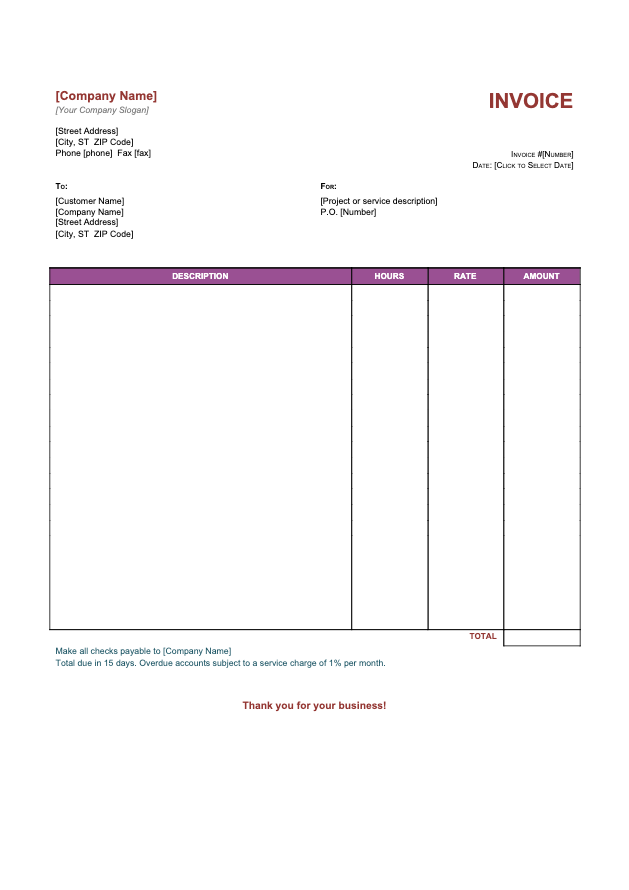

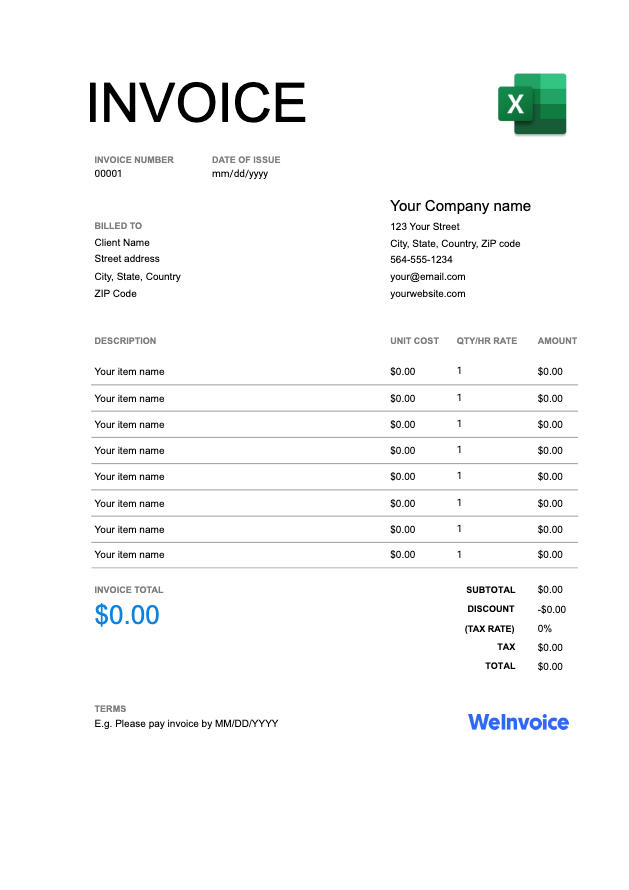

You can download a VAT invoice template for free at WeInvoice. It is designed by professionals to offer you time-saving accounting and billing, helping in getting paid two times faster. Manage all your bills and track due dates through WeInvoice free VAT bill templates.

What Is a VAT Invoice?

Value Added Tax (VAT) is a tax added on a product as it moves in the supply chain. A VAT invoice mentions the VAT charges you are making from the customer on every product.

The invoice lists the VAT taxes individually on every product that is sold to the customer. It is important to note that VAT can only be charged for products that are liable for VAT. Not every product or service can incur VAT charges.

For this purpose, to issue a VAT invoice, the business itself must be registered for it. Businesses that are registered for it have a VAT number which they need to mention on the VAT invoices that they issue.

Sole-traders and businesses which are registered for VAT have to keep an accurate record of their VAT invoices. VAT invoice records should be present for a minimum of six years.

An important aspect of VAT invoices is that they can be used for reclaiming the VAT that you paid when it is paid twice as a buyer as well as seller of goods or services.

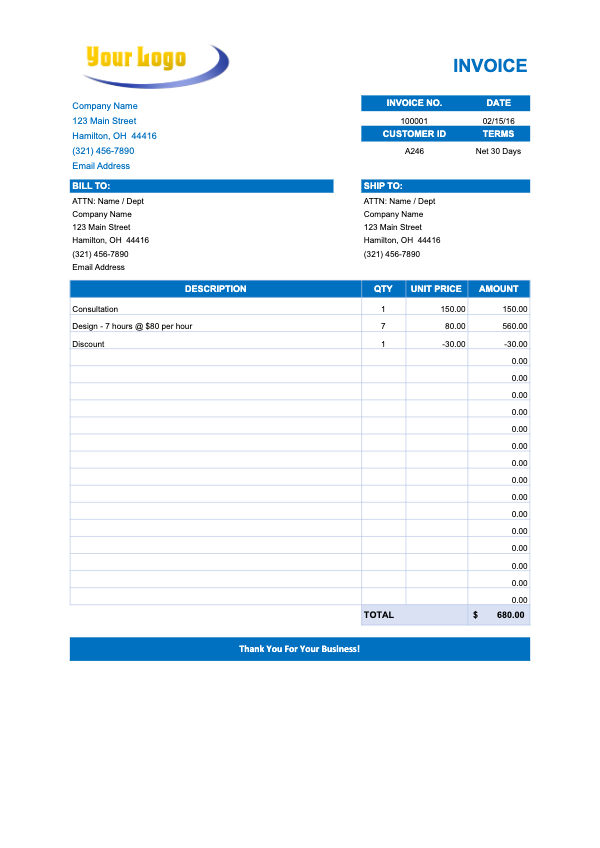

Make an Invoice With WeInvoice

Design your own business invoice and add as many customizations as you need in your invoice. Improve the efficiency of your business by using a quick and easy invoice generator service from WeInvoice.

When Do You Need to Issue a VAT Invoice?

A VAT invoice is issued for sales of products that are liable for the tax. The first and foremost requirement to issue a VAT invoice is that your business has a registered VAT number.

In the absence of this VAT number, you cannot issue a VAT invoice to the customer. Non-registered businesses can only issue standard invoices and cannot charge VAT charges on the products.

An added requirement for VAT invoices is that the business you are issuing the invoice to should also be registered for VAT. In simple terms, both the buyer and the seller must be VAT registered business for VAT invoices to apply.

There is no need for you, as a business owner, to issue a VAT invoice if:

- You are gifting a product free of cost to someone.

- The customer only purchased VAT-exempt products.

- You are not registered for VAT invoicing.

- The customer is not registered for VAT invoicing.

- The customer handles the VAT billing themselves.

What Are the Requirements for a VAT Invoice?

HM Revenues and Customs (HMRC) recommends certain requirements that make a VAT invoice eligible for recognition. In the absence of any of these requirements, you or your customer might be denied reclaiming VAT.

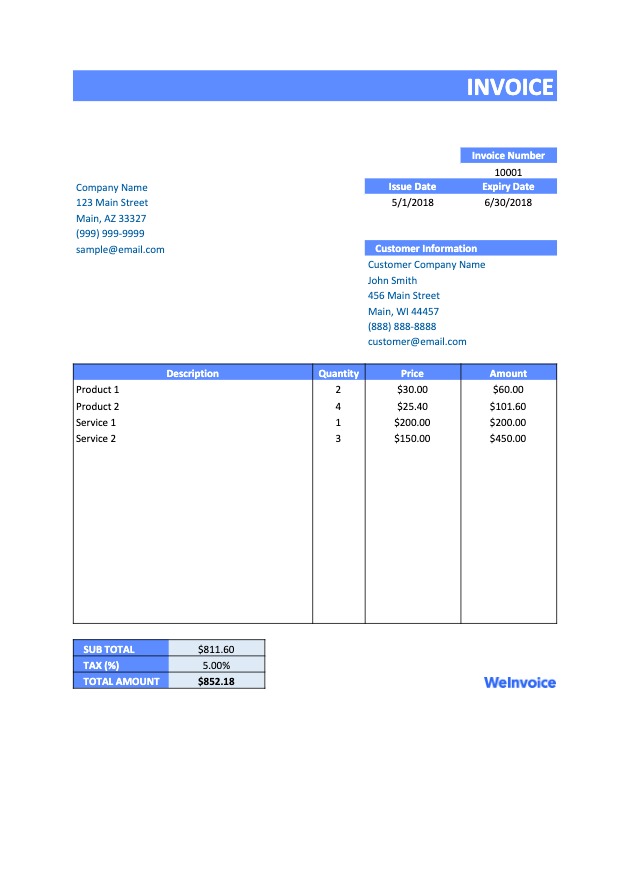

The requirements for the VAT invoice includes:

- Unique invoice number that follows from the last invoice

- Your business information (name and address)

- Your registered VAT number

- Date of issue of the invoice

- Time of supply, in case it is not the same as the date of issue

- Customer name (or their company name) and address

- Description of goods and services

- Price of each item excluding VAT

- Quantity of each item

- Rate of VAT charged on each item (mention no VAT on VAT-exempt and zero-rated items)

- Any discount rate applicable on an item

- The total amount (not counting VAT)

- The total amount of VAT

- The total amount including VAT

Conclusion

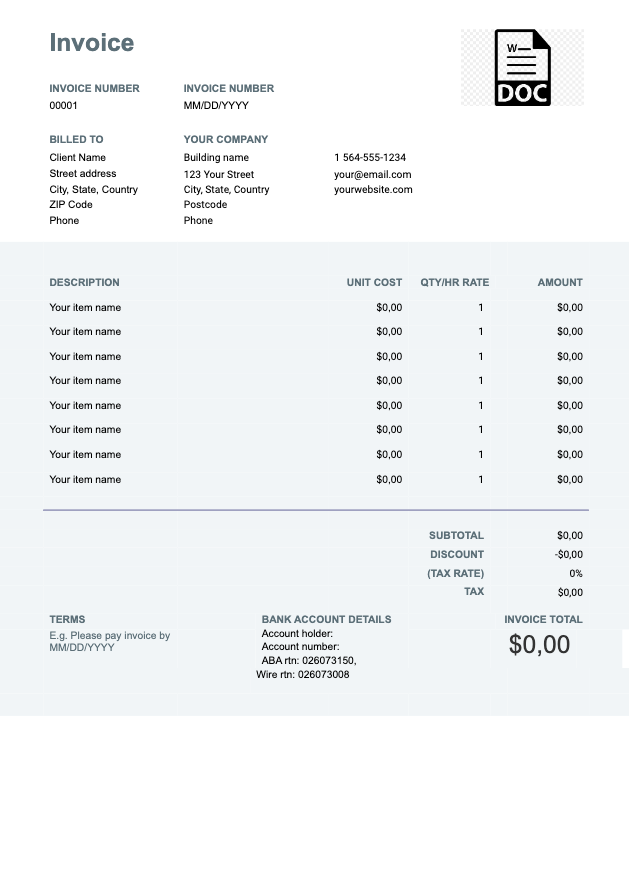

VAT invoices are not only useful for the billing process, but also for reclaiming the VAT amount paid by businesses. For this purpose, you need to use an officially recommended VAT invoice template.

WeInvoice provides a free to download invoice template that you can edit as per your requirements. The basic parts of the VAT invoice template are the same to follow government recommendations.

Download the free VAT invoice template from WeInvoice right away!

Other Invoice Templates