Download Sales Invoice Templates for Free

A sales invoice provides legal protection for both the seller and the buyer. It also aids the seller’s bookkeeping processes and files sorting should any dispute arise.Come and get one now at WeInvoice.

What Is a Sales Invoice And How Does It Work?

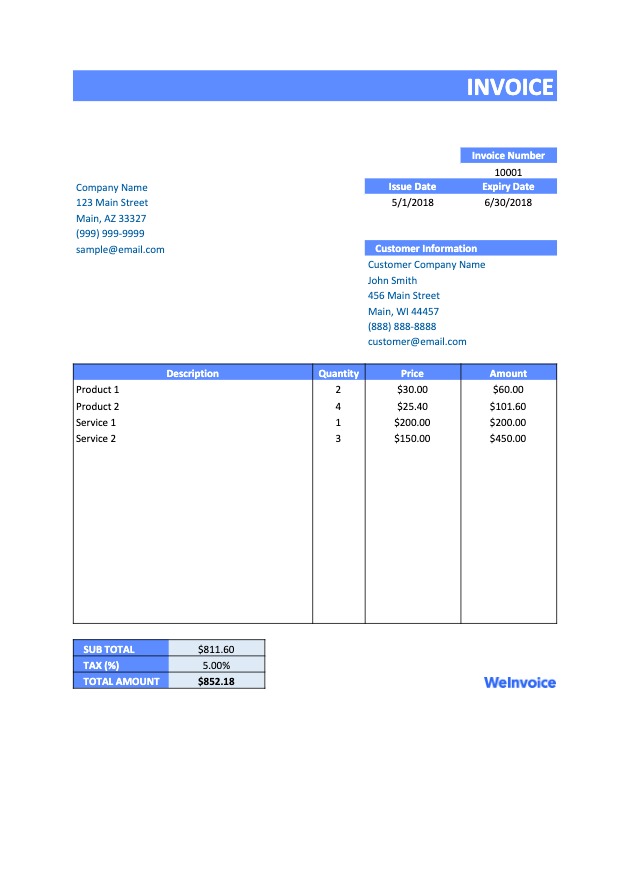

A sales invoice is a document issued by the provider of a product or service to his/her client to make a request for the payment due in exchange for the product or service delivered.

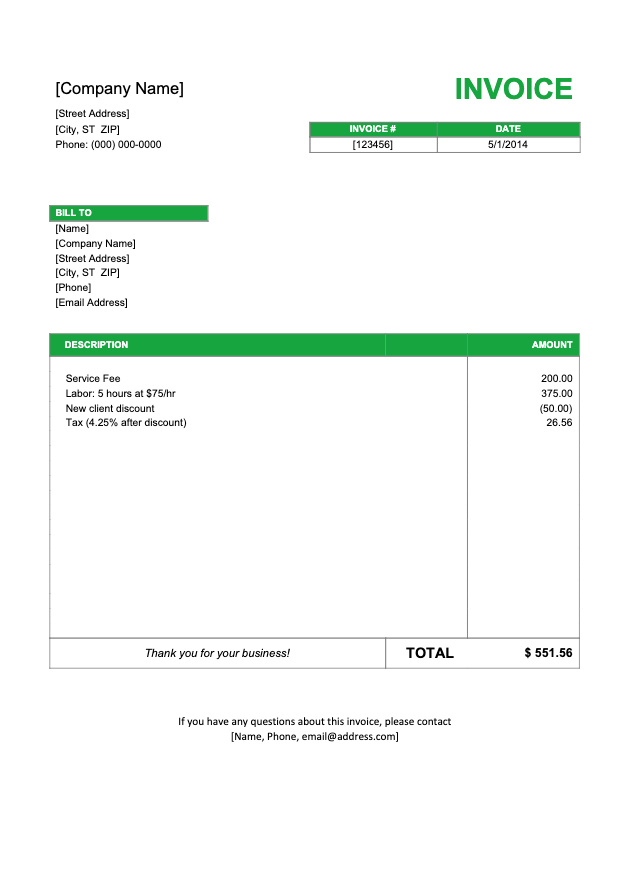

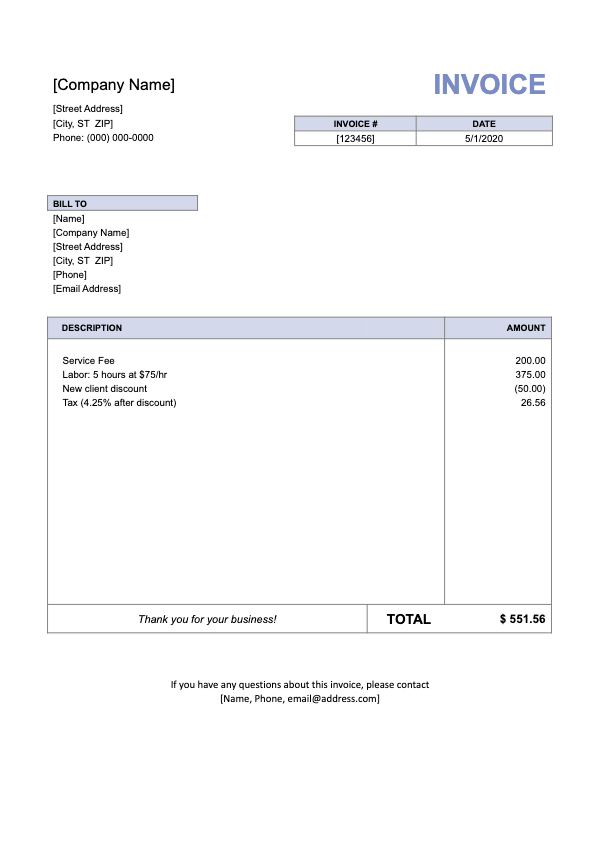

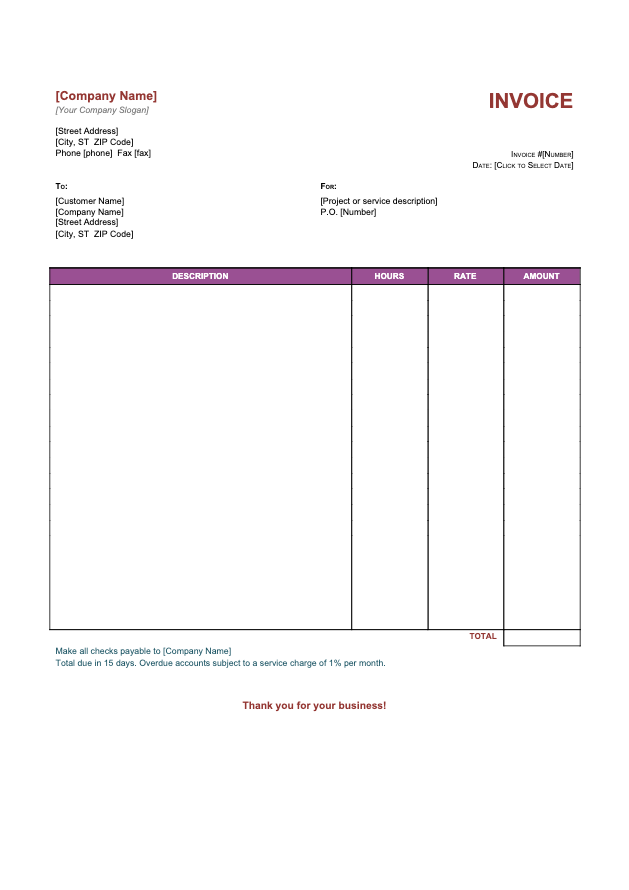

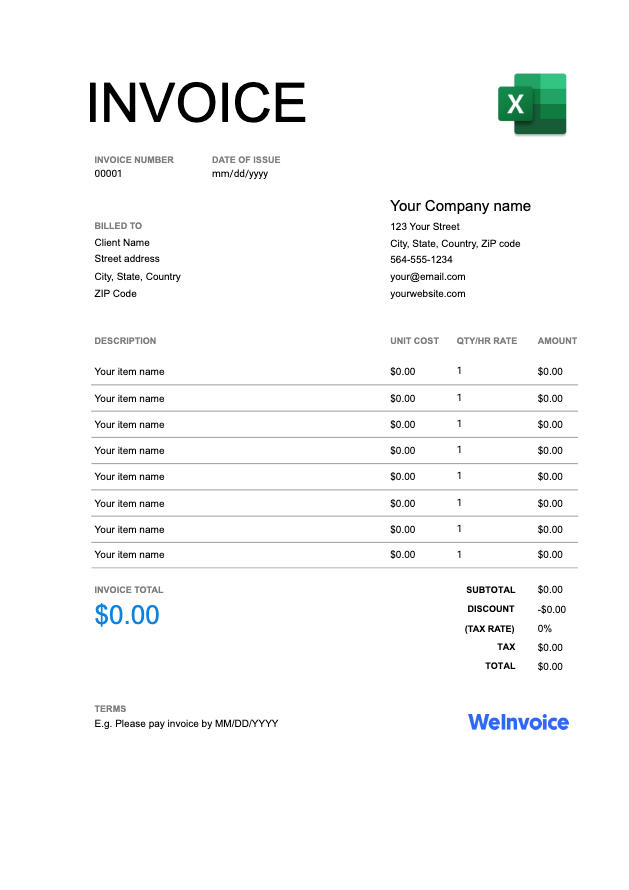

The sales invoice should outline what items have been purchased, how many units, the discount (if applicable), taxes and total amount owed. In the case of services provided, the usual format is the type of services provided, number of billable hours, fixed or hourly rate for each of these services and total amount owed.

Some seller-buyer relationships require that the buyer makes an upfront payment. In such cases, a seller may issue an invoice at the start of the transaction.

Should the work be long-term, there may also be some mutual understanding between both parties and an agreement that the seller or service provider issues an invoice after every milestone is reached. Otherwise, the seller/service provider issues the sales invoice on completion of the entire project.

Since the sales invoice represents your revenue, it should be entered in the revenue section of your ledger (according to the accrual method of accounting).

You may also choose to adopt a financial system of accounting that highlights which sales invoice has been fulfilled and which hasn’t. In this case, a sales invoice that is yet to be fulfilled is recorded under accounts receivable.

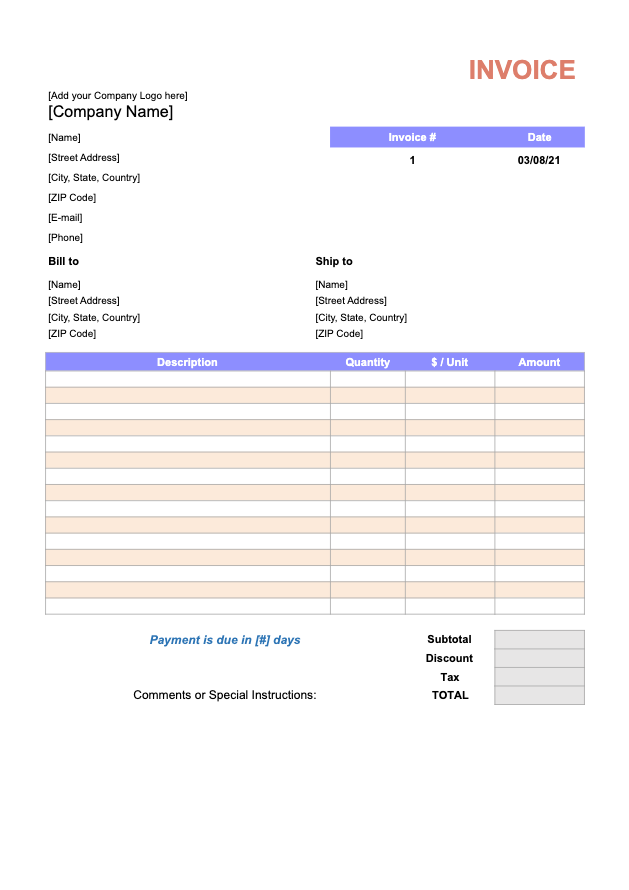

What Should a Sales Invoice Include?

Among other things, a sales invoice can be used as a resource for tax returns and an inventory management tool. If so, there is some vital information it must contain for it to fulfill these roles. Here are some of the components a sales invoice must contain:

- The header “Sales Invoice”

- Unique invoice number and date

- Business and contact information of both the buyer and the seller

- List of products sold/services provided

- Quantity of goods supplied/number of hours worked

- Cost of one unit/hourly rate for services provided

- Subtotal for each service provided

- Payment terms and accepted payment method

- Payment due date

- Additions such as Tax and VAT, and deductions like discount and upfront payment already made

- Total amount owed

Sales Invoices vs. Purchase Orders vs. Bills

These terms are often used interchangeably but there are crisp differences between all three.

To begin with, a purchase order is issued before the transaction while invoices are issued after. Purchase orders are mainly used to record an order made by a customer to a vendor or supplier while a sales invoice records the payment terms and a receipt of the product or service. Some companies use purchase orders as part of the approval process.

The main difference between sales invoices and bills is their contents. Bills are more generic and usually do not contain any customer information while invoices contain more detailed information. Bills are usually issued with the expectation of immediate payment (e.g in a restaurant) while an invoice may set payment for a future.

Worthy of note is that all invoices are bills, but not all bills are invoices.

How to Create a Sales Invoice?

A sales invoice can be developed from scratch on Microsoft Word or Excel but formatting and preparing a good layout can be a tough task to do. For this reason, it is recommended that you work with an invoice template. WeInvoice has several free downloadable sales invoice templates you can get started with.

Wondering how to create a sales invoice? Here’s how

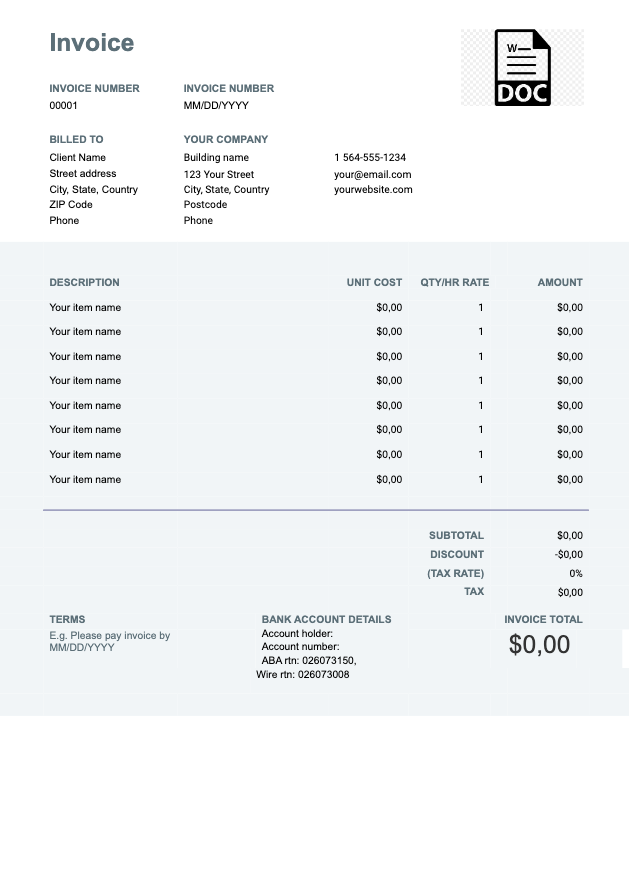

Download sales invoice template

Head to WeInvoice and download any stylish sales invoice template you are comfortable with. Make a copy of the template and save.

Insert business information

Edit the header section of the template to insert your business details. These business details include your business logo, name, contact address, email address and phone number.

Include client’s contact information

Below this line of business information, enter the contact details of the client. Make sure the contact address in this case is the billable contact address. In other words, if it is a company you are dealing with, the billable contact address may be different from that of the company’s representative you have been in touch with.

The email address and phone number should also be that of the company.

Assign a unique invoice number

Adopt the popular serial invoice numbering system and generate invoice numbers for all your invoice sheets. For instance, you may number your invoice sheets thus: #0001, 0002, 0003, 0004 and so on.

The invoice number is an essential component of your invoice because it serves as a reference number that can be used in discussions with your clients.

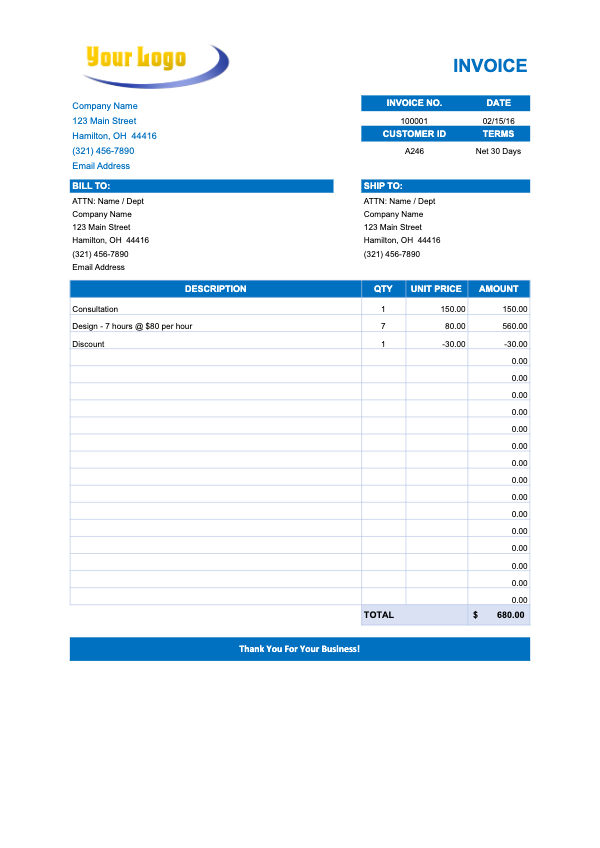

Outline the goods provided or services supplied

Here, you have to itemize the services you have provided with a brief description of these services. The former is usually included in the second column while the first column contains the brief description about the service.

Other columns should contain the quantity supplied (for products) and billable hours (supplied).

Enter the payment terms

Write in clear font what your payment terms are. Here, you should state whether or not there will be a discount for early payments and if there will be a fee for late payment.

You should also state the acceptable payment methods. Some of the popular payment methods include use of credit/debit card, cash, cheque and payment platforms like PayPal and Payoneer.

Include the payment date

Clearly write out the deadline for fulfilling the sales invoice. By writing clearly, we mean use of the exact date like “Payment due June 25, 2020" rather than a more ambiguous or vague due date like “Payment Due in two weeks”

Write out the total amount owed

Clearly highlight how much the client is owing. It is recommended that this is written in bold and legible font.

Do you need to create a professional invoice for your goods? Do you need a detailed invoice that can help you verify your tax claims as well as protect yourself from unsubstantiated lawsuits a client may choose to file?

This article shows you what a sales invoice should contain and how to write one. You also get access to the loaded resource of free downloadable sales invoice templates on WeInvoice.